Accounting and invoicing of a limited company easily and affordably

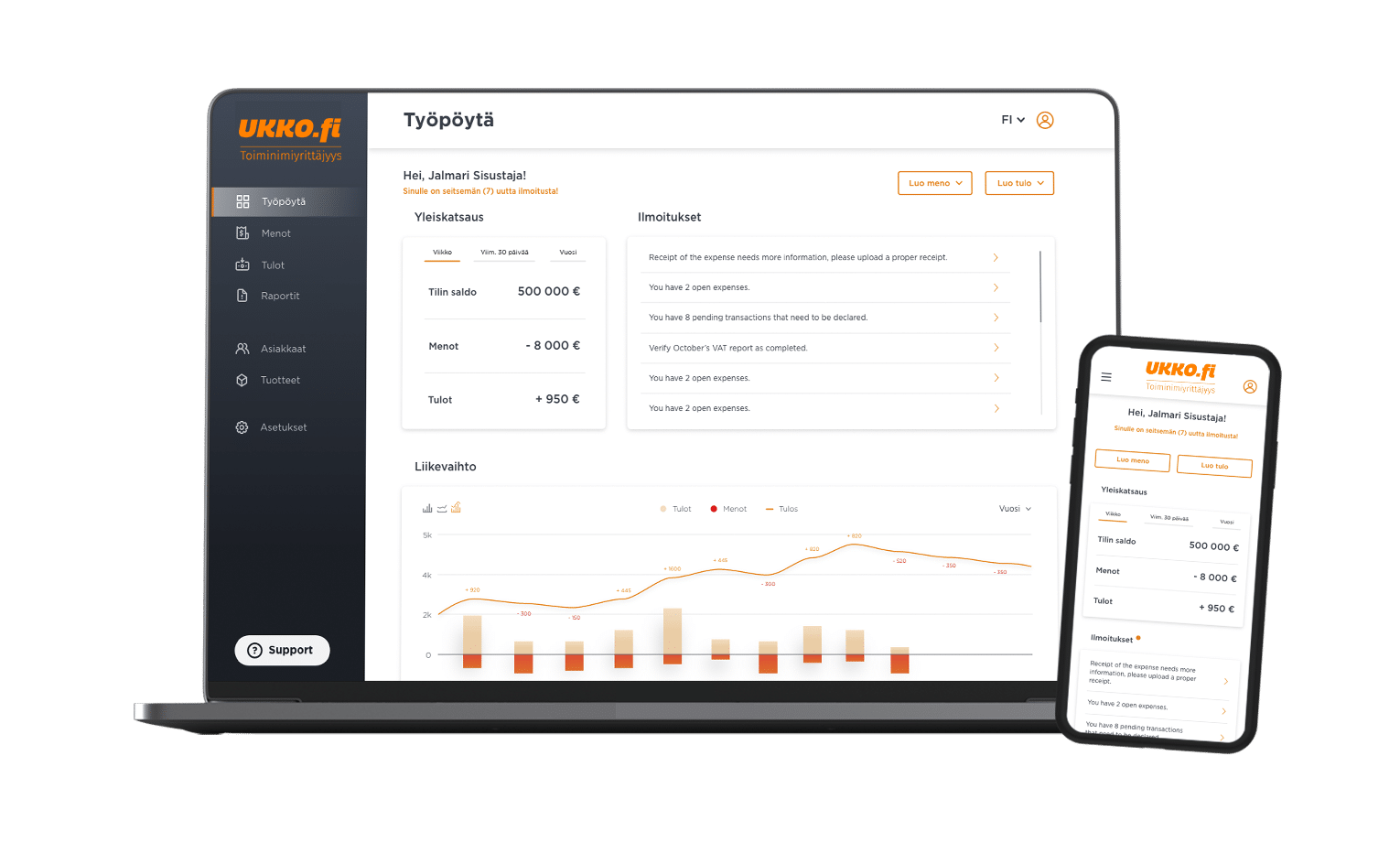

UKKO Entrepreneur is a financial management solution, where a limited company’s accounting, invoicing, financial statement and everything necessary is managed through one service.

What are other UKKO Entrepreneurs saying about us?

Accounting and invoicing service for a limited company designed for entrepreneurs, with which you take care of everything you need without surprise costs

The UKKO Entrepreneur service includes everything from invoicing to accounting, financial statements and payroll for the entrepreneur’s salary. Let us make your entrepreneurship easier for you.

You can establish a limited company conveniently when registering

Setting up a limited company couldn’t be easier! You only fill in the necessary information, and the foundation documents will be sent to the Finnish Patent and Registration Office for approval.

When starting a company through the UKKO Entrepreneur service, you immediately get all the necessary financial management tools at your disposal.

When setting up, you only have to pay the trade registration fee; if the establishment is done electronically, the fee is 280 euros, and if it is done using a paper form, the fee is 380 euros. You can deduct the payment as a business expense immediately after establishment.

No surprising additional costs, e.g. you get all this for a fixed monthly price:

- Unlimited invoicing

- Automatic reading and storage of receipts

- Accounting

- Financial statements and tax returns

- Entrepreneur’s payroll

UKKO Entrepreneur is best suited for small specialist companies

The service is designed to best serve entrepreneurs who want to easily invoice for their own expertise and don’t have employees.

Do you already have a limited company?

If you already have a limited company with previous accounting records, please contact our customer service in this case.

No matter what you need, we will help with that

We are happy to serve our customers’ other needs flexibly. That’s why we have priced any additional services you may need in advance.

UKKO Assurance – so that no limited company entrepreneur is left to their own luck

UKKO Assurance is a comprehensive insurance for entrepreneurs. It helps in many situations, such as agreeing on valid assignments or accidents or damages that occur at work.

- Insurances: accident insurance and liability insurance

- Agreement template library

- Powers of attorney’s and documents

- Sales school and marketing school

- Other benefits, e.g., car rental companies and offices

UKKO Assurance is available to all registered users. UKKO Assurance is activated from the UKKO Assurance tab within the service.

You know what you are paying for and what is included in the price – no surprise costs

Our affordable monthly price includes the limited company’s accounting, invoicing, authority notifications, financial statements, payroll of the entrepreneur’s salary and other handy features that facilitate invoicing, adding receipts and monitoring your finances.

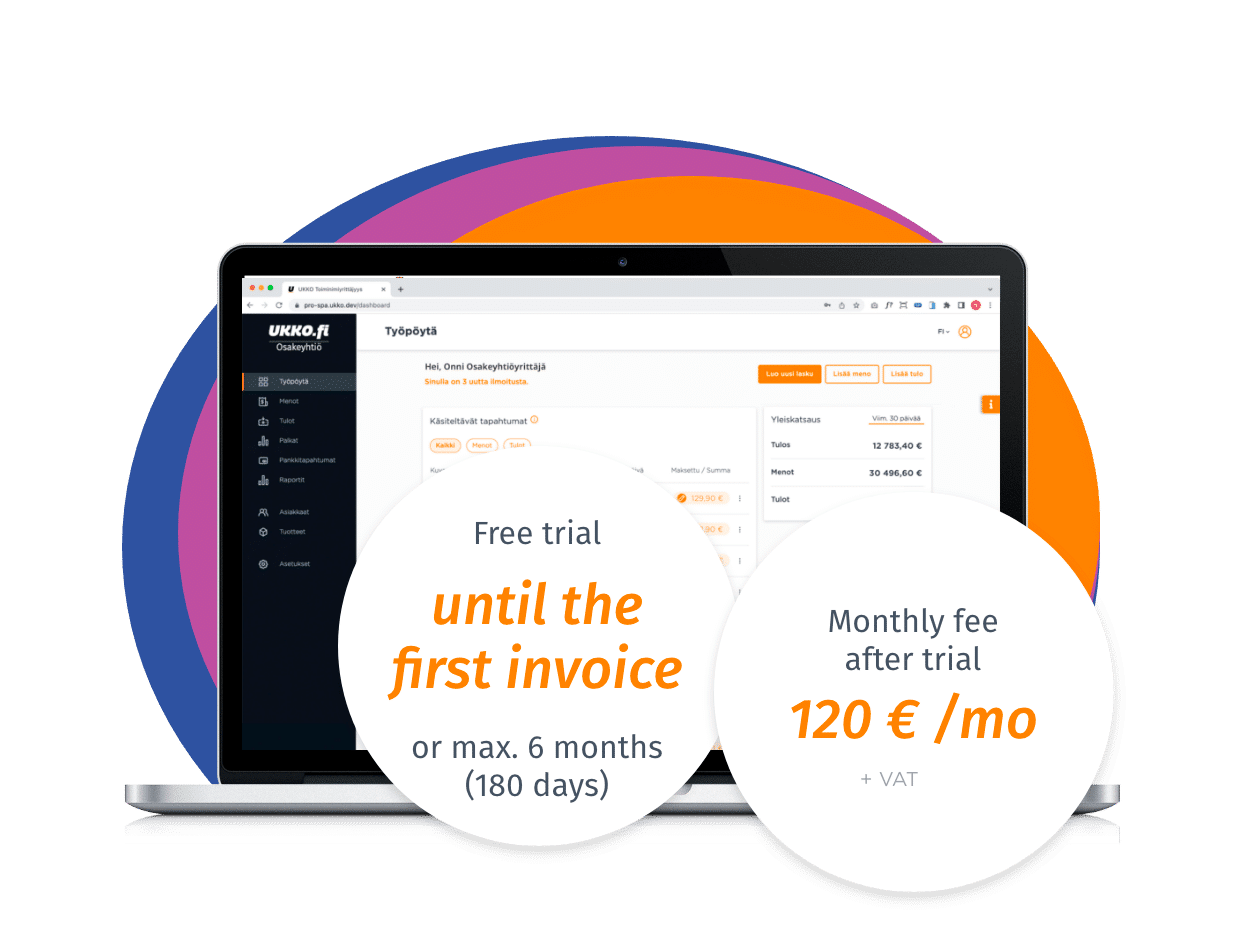

Starting entrepreneur: you only pay for the service when you send the first invoice

We want our pricing to support small entrepreneurs starting out. As a new entrepreneur, you can use our service for free for up to six months. You don’t have to pay anything unless you invoice your customers or generate revenue during that period. We want to encourage entrepreneurs and have therefore made the initial steps as easy as possible for entrepreneurs.

If you establish a new limited company, you will only have to pay an official fee at the time of establishment; it is 280 € for an electronic establishment and 380 € for a paper form. You can deduct the payment as a business expense immediately after establishment.

This is how easy it is to establish a limited company in UKKO Entrepreneur service:

Focus on your business – don’t worry about financial management

We offer you a hassle-free and fast way to create and send invoices in the same service. You receive all your invoices conveniently in one place, so all you need to do is add your receipts to the service easily as images. Your accounting takes care of itself while our experts and accounting professionals ensure its accuracy. This is how easy corporate financial management should be!

Our service leverages modern technologies such as machine learning and automation, but ultimately, our experts ensure that your accounting is in order. You can also get assistance from us on accounting and financial management matters – our experts provide guidance completely free of charge.

We support your every step of your limited company journey

Free customer service

Our customer service and financial experts will advise you on all matters related to a limited liability company. You will receive answers to your own company and accounting issues quickly, and you will not pay anything extra for it. On the UKKO.fi website you will also find plenty of articles, guides and tips that will help you progress in entrepreneurship.

Learn about entrepreneurship at Entrepreneurship school

Progress at your own pace and find all the information you need about entrepreneurship in one place. Entrepreneurship school is developed for the needs of small-scale entrepreneurs: we cover topics that are important for business and break them down into simple articles that will quickly give you the information you need. The articles and guides tell you everything you need to know about, for example, taxation, YEL insurance and marketing.

Contact us

Jimi Forsman

Sales Representative

+358 50 434 7273

jimi.forsman@ukko.fi

Miro Tiala

Sales Representative

+358 50 460 2442

miro.tiala@ukko.fi

UKKO Entrepreneur meets the needs of limited company entrepreneurs

In Finland, there are already over 270,000 limited companies, making it the most popular business form in the country. Sometimes, a limited company is seen as a challenging option since it requires more administrative work compared to being a private trader. At UKKO.fi, we aim to simplify the everyday life of small entrepreneurs, ensuring they can focus on their core expertise and growing their business, regardless of the business form.

The UKKO Entrepreneur service acts as a reliable tool that manages your accounting electronically in an automated platform. At the same time, you can monitor your company’s finances in real time and send invoices to your customers in just a few minutes.

A limited company enhances credibility for small entrepreneurs

A limited company is often chosen as the business form when aiming for growth. For this reason, it is often perceived as the most credible form of entrepreneurship. It provides marketing advantages and strengthens your company’s reputation — an essential factor for customers, partners, and potential investors.

Choosing a limited company reflects a serious commitment to your business and offers flexibility, such as hiring employees and seeking funding. This is especially important in scenarios where your business deals with large companies, seeks to secure significant contracts, or is actively acquiring new customers without an established clientele.

A limited company is suitable for a variety of businesses and entrepreneurs

A limited company is an excellent choice in the following scenarios:

- You want to separate personal assets and liabilities from your business.

A limited company is an independent legal entity, so its owners are generally not personally responsible for its debts or obligations. - You aim to secure funding from external investors.

Unlike a private trader, a limited company can sell shares and attract investors, making it easier to grow your business. - Your business is profitable, and you want to take advantage of tax planning.

With a limited company, you can draw income in various ways and benefit from lighter capital gains taxation.

Is a limited company right for you?

We recommend considering your specific needs, the nature of your business, and future plans before establishing a limited company. The experts at UKKO.fi are happy to help assess whether a limited company suits your situation.

By booking a consultation below, we’ll review your plans together and advise you on choosing the most suitable business structure. At the same time, we’ll answer all your questions about using the UKKO Entrepreneur service and its features.

Administrative responsibilities of a limited liability company (Oy)

When choosing a business form, it’s essential to consider the entrepreneur’s statutory responsibilities and obligations. For this reason, many solo entrepreneurs opt for the least administratively burdensome forms of entrepreneurship, such as light entrepreneurship or operating as a private trader. Limited liability companies are sometimes avoided because they come with significantly more time-consuming responsibilities and obligations. However, while managing a limited company can be more demanding, you don’t have to handle all the administrative tasks yourself.

UKKO Entrepreneur is designed specifically for small business owners who want to enjoy the benefits of a limited company with minimal effort in its administration.

With UKKO Entrepreneur:

- We handle the establishment of your limited company or the transition from your current accounting firm.

- You can focus on running your business while we manage the accounting for your limited company.

- Simply add your company’s income and expenses to the service — easily done via our digital platform.

- Financial experts ensure your company’s accounting is accurate and compliant.

- All necessary tax declarations, income statements, and financial statements are prepared for you.

- Access our easy-to-use invoicing tool and send unlimited invoices via email, postal mail, or e-invoicing.

- View your company’s real-time financial status at a glance.

- Our highly-praised customer support offers free advice on any questions or concerns you may have.

- Know exactly what your accounting will cost — you’ll get all this for a fixed monthly fee of 120 € + VAT.

Try the service for free!

By registering for the UKKO Entrepreneur service, you can explore its features before establishing your business or transferring your accounting. If the service meets your needs, you can try it for free for 30 days!Double-entry bookkeeping for limited companies

Unlike private traders, limited companies are required to maintain double-entry bookkeeping and prepare financial statements. However, with the UKKO Entrepreneur service, these tasks are handled effortlessly, allowing you to focus on running your business.

Double-entry bookkeeping records each business transaction on two separate accounting accounts. For every transaction, there is both a debit and a credit entry. The debit entry shows where the money is used, while the credit entry indicates the source of the funds.

The principle behind double-entry bookkeeping is that the total debit and credit amounts must always balance. This ensures that every transaction affects both the company’s assets and its equity. For example, when a company sells a product, the income from the sale is recorded as a debit to increase revenue, and the same amount is recorded as a credit to reflect the increase in assets.

Double-entry bookkeeping offers an accurate and organized way to monitor a company’s financial situation. It enables the preparation of financial statements and provides insights into the company’s profitability and financial position. This bookkeeping method is widely recognized and mandatory for limited companies and many other business forms.

In the UKKO Entrepreneur service, double-entry bookkeeping for limited companies is cash-based. This means that receipts are recorded in the bookkeeping system based on their payment date. All you need to do is enter your income and expenses – the rest takes care of itself!

How does a limited company owner draw a salary?

The owner of a limited company can take income from the business either as dividends or as a salary. The UKKO Entrepreneur monthly service fee includes one salary calculation per month for the owner. Simply submit a salary calculation request in the service, and we’ll handle the payroll process and provide you with the necessary details for paying social security contributions. We also manage all payroll-related reporting to the income register.

Dividend distribution is equally straightforward within the service. Once your financial statement is ready, you decide if you’d like to distribute dividends. Based on your decision, we’ll finalize your financial statement and handle all required official filings on your behalf!

Has your accounting been handled elsewhere before?

The UKKO Entrepreneur service covers all your accounting and invoicing needs for a limited company. You can register for free and explore all its features right away!

If you like what you see, you can input your company details into the service, complete strong authentication, and authorize us to manage the transition from your previous accounting firm on your behalf.

And when you start using the service, you can take advantage of a 30-day free trial!