Setting up your own business name for free

Through the UKKO Entrepreneur service you can set up a business name easily. You will get a business ID right away.

This is how easy it is to establish a business name for a private trader:

Fill in the information during registration

We ask for your contact information, as well as in which industry you work.

You get a business ID

When you have confirmed your identity at the end of the registration, you will get a business ID.

We will report you to the tax administration’s registers

We will add you to the VAT and tax prepayment registers.

Create a business name for free as a private trader

You are clearly considering starting a business name, great! Working as a private trader may seem scary at first, but don’t worry: let’s travel the journey together. It is easy to establish a business name through us and we will help you with all your financial administration questions. For private traders, we offer bookkeeping software that makes the company’s financial management run smoothly, and you don’t need a separate bookkeeper!

Forget bureaucracy and thinking about difficult forms. We take care of setting up the business name for you as a private trader. Easy, fast, and completely free! You will receive a business ID upon registration! Through our service, thousands of private traders are starting their business every year.

Advantages and disadvantages of a private trader

Establishing a private trader has always been the most popular form of business among sole traders. And no wonder, because it is easy, fast and even completely free to set up private trader online today. Especially if you set it up through UKKO Private trader service.

Being a private trader offers you several advantages, including:

Establishing a private trader business is quick and affordable.

Setting up a private trader business is inexpensive, as it does not require an initial capital investment, and there are no costs associated with the establishment itself. Through UKKO.fi, you can obtain your business ID immediately, saving you the hassle of filling out forms.

If you want to protect your business name or operate in a regulated industry, you must also register with the Trade Register. Registration costs €70 online or via paper application (in 2024).

Easier to market and sell services.

A private trader business is suitable for all industries, and it’s easy for your clients to claim tax deductions for work performed under a business ID.

Option for single-entry bookkeeping.

If the turnover is small, private traders can use single-entry bookkeeping. In practice, this means recording only income and expenses in the accounting records. This is known as cash-based bookkeeping, where transactions are recorded when money is received into the account or paid in cash. Single-entry bookkeeping also does not require the preparation of financial statements.

Simplified taxation.

Taxation for a private trader is handled as part of your personal taxation, making it much simpler compared to a limited liability company. The assets of the business are also the private trader’s personal assets, and the profit—i.e., taxable income—is taxed as personal income. On the other hand, the assets of a limited liability company belong to the company and cannot be used freely.

Right to deduct expenses and purchases from taxes

One of the greatest benefits of being a private trader is the ability to deduct business-related expenses in taxation. In practice, this means that the entrepreneur can report the costs of purchases essential to the business operations made during the year in their tax return. These expenses are deducted from the total tax amount, thereby reducing the overall tax burden.

For example, the entrepreneur can deduct all work-related furniture and tools, such as a computer and phone, workspace usage costs, as well as expenses related to marketing and accounting.

Enjoy a 5% entrepreneur deduction

All private traders are entitled to a 5% entrepreneur deduction on their earnings as a private trader. This portion of the income is entirely tax-free, meaning you do not pay taxes on this 5%. In contrast, limited liability companies or freelancers billing through invoicing services without their own business ID are not eligible for this deduction.

Easily terminate or expand your business

If an entrepreneur feels that their business did not become profitable, terminating a private trader business is much simpler than shutting down a limited liability company. On the other hand, if the business thrives and plans to expand, converting a private trader business into a limited liability company is also straightforward.

Operate in regulated industries

Regulated industries, such as taxi services and healthcare, require a business ID. We also provide guidance on applying for the necessary permits.

Save on invoicing fees

If you bill without your own business, you must use a freelancer or invoicing service, which charges a service fee for invoices. As a private trader, you save on these invoicing fees.

Benefit from VAT relief

As a private trader, you can take advantage of VAT relief if your annual turnover is less than €30,000. This means you can get back part or all of the VAT you’ve paid by the end of the year!

Potential challenges

- The private trader is not a separate legal entity, so as a private trader, you are responsible for the contracts and commitments you make with your personal property. If you don’t want to be responsible for your company’s finances with personal assets, a limited company might be a better solution for you.

- The income you earn under your business name is always your personal income. With high income, your tax rate is also high. In a limited company, on the other hand, you can pay yourself a suitable amount of salary and leave the rest of the money to your company’s bank account to wait for years to come. As a private trader entrepreneur, this is not possible.

Set up a business name for free today

Start as an entrepreneur now!

Why do we set up a business name for free for private traders?

In addition to establishing a business name for private traders, we help you manage your financial affairs correctly and smartly.

We offer an automatic bookkeeping service online for private traders. To be able to use the great software, you need a business name and a business ID. Since you don’t have a business name yet, we’ll rush to your help. The beginning of entrepreneurship is more comfortable to walk together!

We advise our users in all matters related to the finances of an entrepreneur, because it can be difficult to understand the finances and taxes of an entrepreneur at first, and there are many exceptions. No one should have to learn something new alone, and that’s why you can always call our customer service and ask for advice on the ins and outs of entrepreneurship.

Do I have to buy a paid business name bookkeeping service at the same time?

Answer: No.

If you just want to get in affordably and take advantage of our trusted service, you can of course just take a free business name for private traders. However, it’s worth testing our service: thanks to tiered pricing, it’s completely free for starting entrepreneurs until your business starts or you’ve been a user for 6 months. Once you’ve already registered, why not let us save you time and effort by taking care of your private trader bookkeeping and preparing your VAT and tax returns for you!

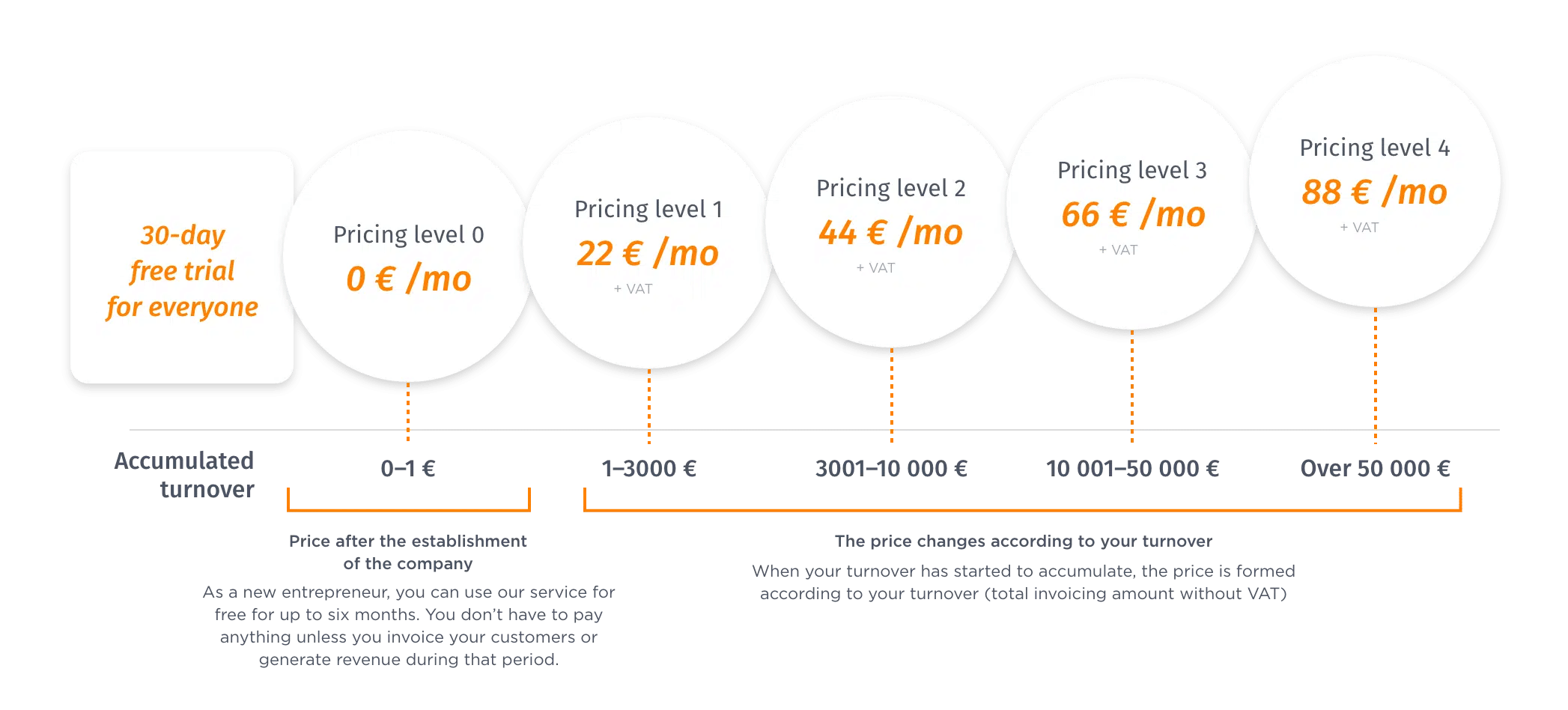

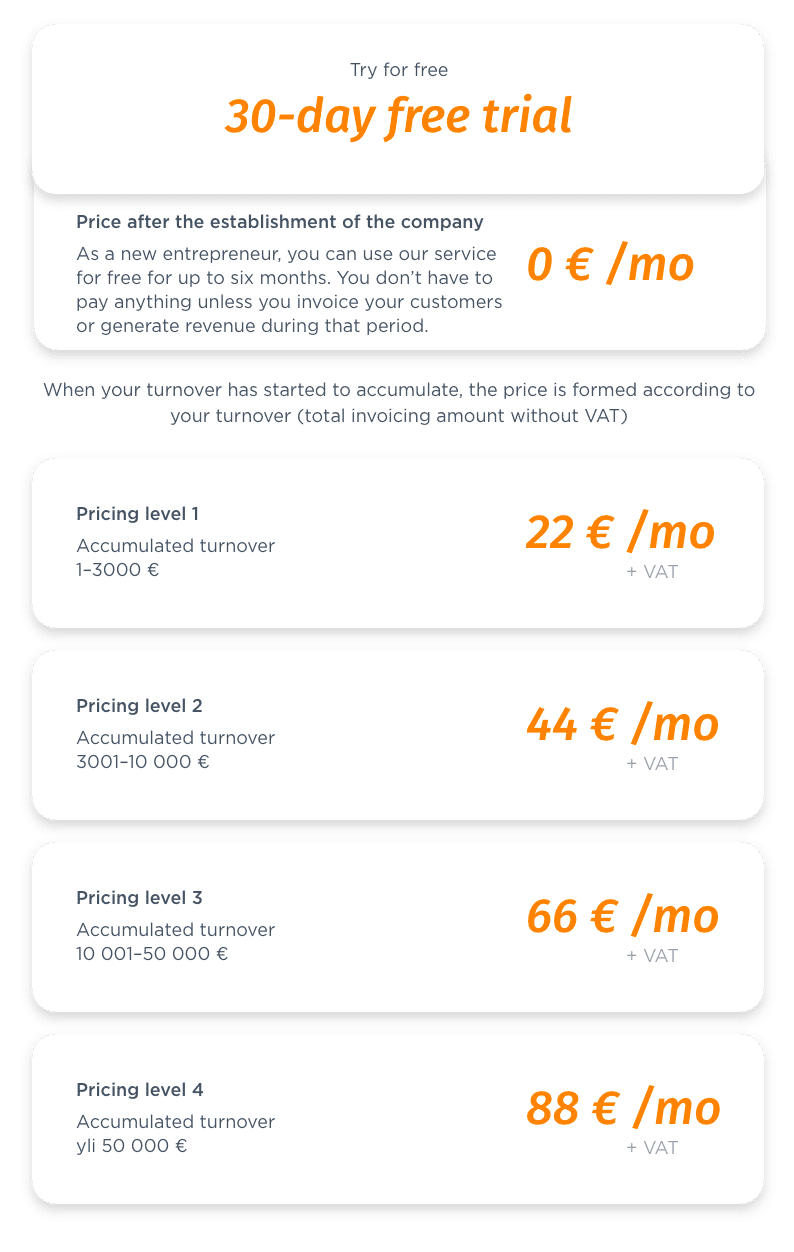

Read more about the pricing of the UKKO Entrepreneur for private traders

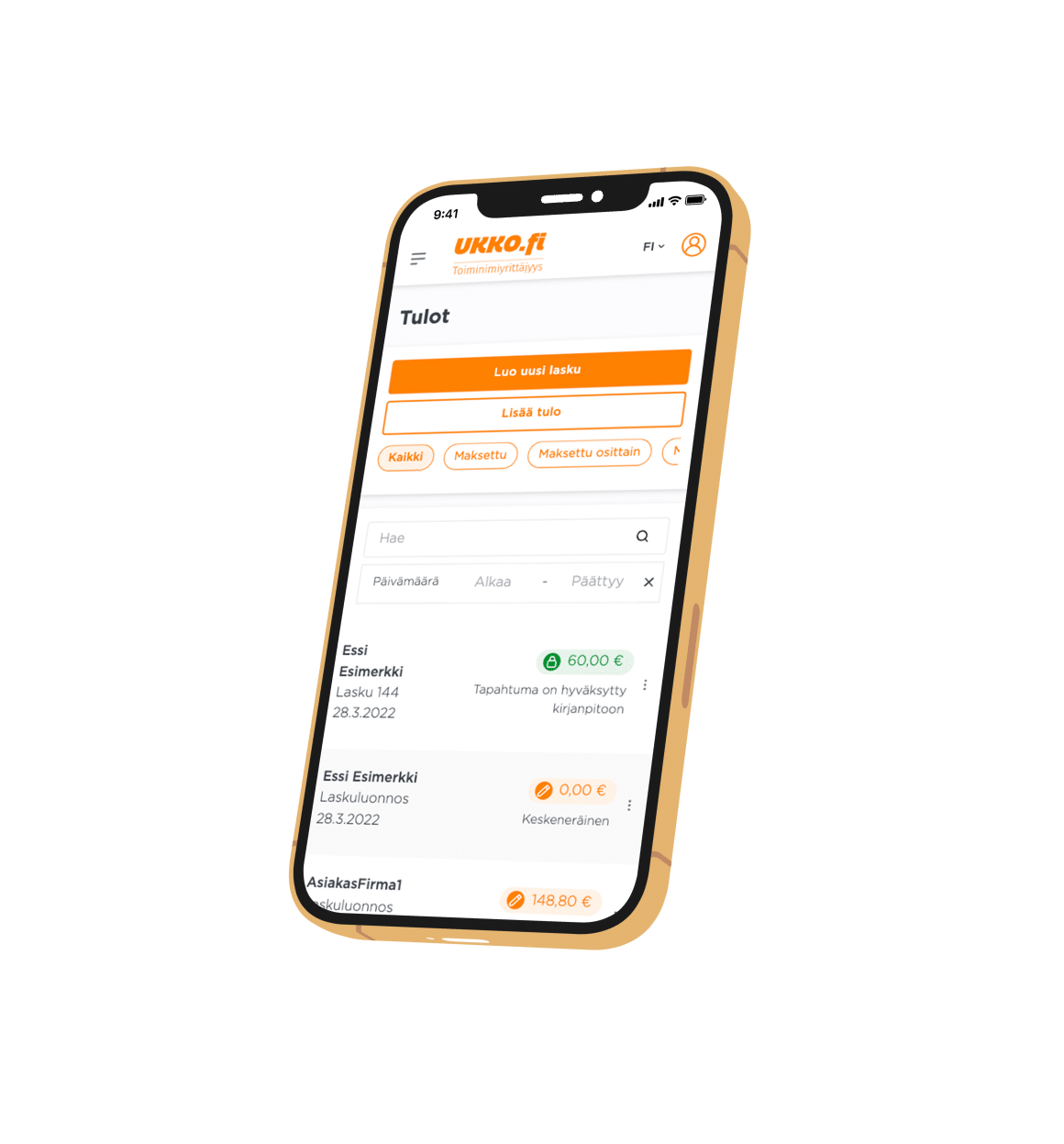

The easiest way to work as a private trader

With the UKKO Entrepreneur service, you can manage your company’s invoicing and accounting easily and effortlessly. The smart operating system allows you to send invoices and add receipts on all devices. You don’t need separate programs, it’s enough that you have access to the internet. Add a picture of the receipt, even at the checkout on your phone!

The service is suitable for you when:

- You sell services and/or products.

- Your activity is continuous.

- You are of legal age.

- Your accounting can be handled in a single-entry.

- You want your accounting, VAT, and tax returns to be done for you.

- You want the bureaucracy to be handled for you.

- You want the option to deduct purchases in your accounting.

Know what you’re paying for – clear monthly pricing

The affordable monthly price includes bookkeeping for a private trader, invoicing, official notifications, and other handy features that facilitate invoicing, adding receipts and monitoring your finances.

Starting entrepreneur: you only pay for the service when you receive the first payment from your clientWe want our pricing to support small entrepreneurs starting out. As a new entrepreneur, you can use our service for free for up to six months. You don’t have to pay anything unless you invoice your customers or generate revenue during that period. We want to encourage entrepreneurs and have therefore made the initial steps as easy as possible for entrepreneurs. |

An affordable fixed-term contract for those who invoice a lot – save 228 eurosOur pricing is based on accumulated turnover. When the company’s lifetime turnover reaches the 50 000 euro limit, you save 228 euros by using a 12 month fixed-term contract, in which case you pay only 69 euros + VAT/month for using the service. You can use the fixed-term contract easily from the service settings section. |

Contact us

Jimi Forsman

Sales Representative

+358 50 434 7273

jimi.forsman@ukko.fi

Miro Tiala

Sales Representative

+358 50 460 2442

miro.tiala@ukko.fi

What does UKKO Entrepreneur include?

Private trader

The word private trader is often used colloquially to refer to a private entrepreneur. The private trader, “toiminimi” in Finnish, officially means the name of the company, regardless of the type of company. When talking about a private trader as a company form, the abbreviation “Tmi” is often used. The tax administration, on the other hand, uses the term “self-employed” for private trader entrepreneurs.

A private trader may be established by a person who resides in the European Economic Area and is at least 18 years old. A minor may also establish a business name with the consent of the guardian. Typical private trader entrepreneurs include hairdressers, graphic designers, consultants, construction professionals, masseurs, and taxi drivers.

Unlike other forms of business, a private trader (or business name), is personally responsible for all business activities. Thus, a private trader is not a separate legal entity, as in a limited company, the entrepreneur and the company are separate. Therefore, if you take out a loan for your company, you are personally responsible for repaying the loan. Also, taxation is always treated as part of your personal taxation. However, a private trader entrepreneur has a corresponding possibility to raise the company’s assets as private withdrawals.

The private trader is still one of the most popular company forms in Finland, although many other alternatives have come along. A private trader is easy to set up thanks to reduced bureaucracy. Also, private traders have fewer obligations than, for example, limited companies. But for whom is the private trader suitable? And how is a private trader established? On this page, you will find answers to the most common questions about private trader entrepreneurship.

Private trader taxation

Taxation for a private trader may initially seem a bit complex, but we aim to explain it as simply as possible. Generally, private traders pay two types of taxes: prepayment taxes and value-added tax (VAT). When starting a business, it’s advisable to simultaneously register for the Prepayment Register and VAT liability to simplify tax management. If you establish your private trader business via the UKKO Entrepreneur service, we’ll automatically handle these registrations for you.

Private trader taxation is primarily based on the business’s profit. Profit is calculated by deducting expenses incurred from generating income from total revenues. This profit is then taxed as the private trader’s personal earned or capital income. Capital income is taxed on an amount equivalent to a 20% return on the previous year’s net assets, while the remainder is taxed as earned income. Net assets are calculated by subtracting liabilities from assets.

If desired, private traders can request that only a 10% return on net assets is taxed as capital income or that all income is taxed as earned income. It’s also important to note that the length of the accounting period can affect the proportion of capital income. These earned incomes are taxed via the so-called prepayment taxes.

Prepayment Tax

Prepayment taxes are determined based on your business’s estimated profit. You provide the tax authorities with an estimate of your expected sales for the year, and they use this estimate to calculate how much tax you should pay in advance — hence the name "prepayment tax."

You can adjust your estimate throughout the year, similar to how employees can adjust their tax cards. It’s wise to start with a conservative estimate since your prepayment taxes are based on your projection. Even if your actual sales fall short of your estimate, you will still be required to pay taxes based on the projected figure rather than your actual profit. Therefore, it’s crucial to update your estimate as needed.

If you’ve overpaid taxes during the year, the excess amount will be refunded to you. Conversely, if your payments fall short, you’ll need to pay the difference, often referred to as back taxes.

Value-Added Tax (VAT)

Value-added tax (VAT) is a consumption tax that is typically paid by the buyer. This means you add the VAT portion (often 25.5%) to the price of your products or services. The buyer pays this amount to you, and you then pass it on to the Tax Administration. This VAT portion is not part of your business earnings but an amount you hold temporarily until it’s time to remit it to the Tax Administration. As an entrepreneur, you can also deduct the VAT you pay on purchases related to your business operations.

The VAT amounts from sales and purchases are reconciled through VAT declarations, which can be filed annually, quarterly, or monthly. These declarations determine whether you owe VAT to the Tax Administration or are eligible for a refund. At the end of the year, you can also apply for the VAT relief for small businesses if your business revenue is less than €30,000.

However, if you use the UKKO Entrepreneur service, you don’t need to worry about this. We handle your VAT declarations and apply for the VAT relief on your behalf when applicable.

Private trader’s salary

A private trader cannot pay themselves a salary but instead withdraws money from the business as private withdrawals. These withdrawals are not taxed directly; instead, the taxable income is based on the business’s total profit, as explained above.

As a private trader, you don’t need to separately pay yourself a salary. Instead, you can make withdrawals from your business account as needed. These withdrawals are recorded in your accounting as private withdrawals. They do not affect your business’s profit or the amount of tax you need to pay. Since tax payments occur retroactively, it’s wise to always keep enough funds in your account to cover VAT and advance tax payments.

Private trader bookkeeping

A private trader may keep simpler single-entry accounting instead of double-entry. single-entry accounting means that transactions are recorded only once, depending on when the money has left the account or when the money has been credited to the account. In double-entry bookkeeping, on the other hand, each transaction is recorded in both debit and credit. Through the UKKO Private Trader Entrepreneurship service, single-entry accounting of a private trader is handled automatically. Read more about private trader bookkeeping from: UKKO Private Trader bookkeeping.

Do I need to open own bank account for a private trader?

Opening a separate private trader bank account is not necessary but recommended. A personal bank account can be used to handle the financial affairs of the private trader, but in practice, it is much easier and clearer to have a separate account for the private trader. However, the account does not have to be a corporate account, but it is possible to operate through a regular bank account.

Part-time entrepreneurship

A private trader is also an excellent option for part-time entrepreneurship. As a part-time entrepreneur, you might work as a freelancer alongside your regular job. You can handle your taxes either through advance taxes or, alternatively, by including your business income in your salary income taxation. In the latter option, you report both your salaried income and an estimate of your business income on your tax card.

This means you’ll pay higher taxes on your salary, effectively covering both your salaried income and your business earnings.

If you plan to operate as a part-time entrepreneur, your invoicing is occasional, and you still want to take advantage of the benefits a business ID offers, we recommend starting with light entrepreneurship with a business ID.

Learn more about the service here: Light Entrepreneurship with a Business ID

When is a good time to establish a private trader?

If a person intends to be self-employed for economic gain, he or she must register his or her business in some company form. The establishment of a private trader is the simplest of the company forms and does not, among other things, require a memorandum of association.

It is not always necessary to register with the Trade Register, but a Trade Register notification is required for all traders who carry out licensed business activities or operate in a separate business premise. Register notification is also required if a private trader uses assistant other than the spouse or family members.

When is it worth becoming a sole trader?

Establishing a private trader makes sense when an entrepreneur intends to work as an entrepreneur alone and has no plans to hire other staff. A private trader is also a suitable option when no strong growth is planned for the business and the business is based either entirely or mainly on selling its own services.

Becoming a private trader is the right option for you when:

- your business is small and you don’t need a lot of capital to start

- you sell your expertise alone and have no plans to expand your business right away

- you also don’t need a large warehouse

If you know right from the start that your operating profit will exceed more than 30,000 euros, you want to hire more employees to help you, or your acquisition costs are high, a limited company or some other form of company makes much more sense.

Benefits for joining the Trade Register

- Your business name is protected, which means no one else can use the same name to do business.

- Joining the Trade Register also gives a reliable picture of your company. Sometimes it can even be strange if a company cannot be found from the register.

Registration in the Trade Register costs 60€ online and 115€ with paper form. You can also apply to the Trade Register with the existing business ID. This is accomplished by making a change notification in the YTJ service.

Establishing a private trader in practice

Where can a private trader be established?

When you want to start a business as a private trader, you have a few different options for doing so. A business name can be established either by registering in the Trade Register in the BIS (YTJ) website. This service is jointly maintained by the PRH and the Finnish Tax Administration. The cost of Trade Register registration is 60€ online and 115€ with a paper form. Another way is to establish a business name free of charge without registering in the Trade Register. This is easily achieved, for example, through the UKKO Private Trader service online.

- The establishment of a private trader through the UKKO Private Trader service is completely free. To set up, you only need a Finnish personal identity number and online banking codes or a mobile ID / ID card with a chip. You need to provide the necessary information on the registration form, such as personal information, a proposal for a business name, and address and contact information. In addition, the domicile and industrial classification of the company must be indicated. Through our service, you get your business ID immediately at the same time as you complete the registration!

- You can also register in the Trade Register after receiving the business ID by making a change notification on YTJ’s website. Registration in the Trade Register costs 60 € with an electronic form and 115 € with a paper form (2021).

It is possible to make a declaration of establishment for example in the Trade Register at the National Board of Patents and Registration, ie the PRH (Patentti- ja rekisterihallitus). One option is also to print the notice on the website of the National Board of Patents and Registration at www.prh.fi.

If you are uncertain about something related to establishing a private trader company, you can be in contact for example with your local TE-service or just call us. UKKO customer service is also happy to advise you.

What does it cost to set up a business name?

Through the UKKO Private Trader service, you can set up a business name for free. After creating a business name, you can also join the Trade Register. Registering a business name in the Trade Register costs either 60€ online or 115€ with paper form (price for registering a business name in the Trade Register in 2021). You can make the notification either on the website of the National Board of Patents and Registration (PRH), in which case you pay 60€ after signing the notification, or alternatively make the application on paper, in which case a receipt for the 115€ payment must be attached to the application.

In addition to the start-up costs, the founder of a business name should consider how he or she intends to manage his or her bookkeeping – self-managed bookkeeping becomes the cheapest but does cause a lot of work for the entrepreneur. Hiring an expert or using an Accounting Service can be a good idea. Additional costs may also come from the purchase of tools and the necessary insurance.

Alternatively, you can let UKKO Private Trader take care of the paperwork for you. The flat service fee also includes accounting and billing, as well as advice from our tax and financial experts by phone.

Does a private trader have to have a business ID?

In Finland, all companies in the Trade Register must have their own business ID, and since the private trader is also a company, it must also have its own business ID.

The business ID is issued by the Ministry of Patents and Registration, the local register office, or the ELY Center immediately after the new company has been entered in the YTJ system. In some cases, a business ID can also be obtained from the tax office.

Usually, the business ID is immediately available when you apply for it online. The paper version then usually takes a few business days, depending on mailing and processing times. If you register at the Trade Register at the same time, it may take a few days to receive the business ID and, depending on the processing times, it may take longer to complete the business ID. The business ID works in the same way as the personal ID for people, ie it identifies the company, for example, in tax matters and other official contexts.

How to choose a business name?

Each private trader is free to decide a name for their business. However, it is limited by the fact that in the Trade Register there cannot already be a company registered with the same name. If it’s hard to find a suitable name, it’s a good idea to check out the business register’s list of companies to see what kind of names companies are using. At the same time, you can also notice if the name you already have in mind is already in use. This is at the same time a preliminary examination of the name, although the final examination is carried out by the Trade Register.

If you find it difficult to come up with a name, a popular way is to combine your name with the company form: “Tmi First Name Last Name”.

The business name should be chosen carefully. It is easier to advertise a business name which is easier to remember as then your customers and partners most likely can remember it better. For this reason, the business name should always be used in the form in which it is entered in the Trade Register, from which it is also recommended to follow the Finnish spelling rules.

Further information on the choice of name and related instructions is available on the National Board of Patents and Registration’s website at www.prh.fi.

After the name has been registered and approved, the trader has the exclusive right to the name throughout Finland.

Does the business name need to be protected?

Registration of a business name in the Trade Register is the most effective way to protect one’s own business name because no two companies with the same name can operate in Finland at the same time. The Trade Register carefully examines the backgrounds of each business name before approving them in the Register. This research takes some time, which is why a new entrepreneur shouldn’t advertise their business name or have promotional products for it until the business name is actually confirmed.

Traders who do not otherwise have an obligation to register in the Trade Register can also register in the Trade Register for the very reason that they receive a protected business name.

When a business name is entered in the Trade Register, it also protects it, for example, if someone tries to register a fi-terminated domain name with the same name.

Private trader is not the only company form

There are different types of companies:

- private trader, i.e. private entrepreneur,

- limited partnership,

- joint-stock company and

- limited company.

Different types of companies exist for different situations and needs: becoming a private trader is perfect for an entrepreneur whose activities are small-scale and do not require specific investments. The sole trader represents himself or herself, i.e. all contracts are made with the entrepreneur, not with the company. Private traders are also referred to as private entrepreneurs.

Being a private trader is particularly well suited for small-scale business. By setting up a business name, you become an entrepreneur with minimal effort: you don’t need separate founding documents, or capital. You act on behalf of the company, meaning you don’t need separate administration for the company. When you become a private trader, in practice, your personal finances are included in the finances of the company. Taxation is similar to personal taxation.

In a joint-stock company, there are two owners, and each can enter into agreements on behalf of the company. A joint-stock company is a lot like a limited partnership, they differ only in that a limited partnership can also have silent partners who cannot represent the company. A limited partnership is suitable when you want to involve an investor, for example. The limited company enables more owners and the majority of the largest Finnish companies are limited companies. A limited company is thus the most popular form if the company has several owners.

The operations of a private trader can be transferred to a limited company as the operations grow or if more owners are desired.

What to do after becoming a private trader?

Once you have established a business name, you are ready to start your business. Before that, however, you will have to embrace a lot of new issues related to taxation and accounting, as well as think about, among other things:

- company marketing,

- bookkeeping,

- customer acquisition,

- private trader insurance,

- entrepreneurial unemployment security,

- as well as a business plan

No worries, we also provide comprehensive information on these topics on our Entrepreneurship School. You can also always call our financial team for clear guidance on entrepreneurship and bookkeeping.

As a new entrepreneur, it is also possible for you to apply for a start-up grant from the state.

If you plan to apply for a start-up grant, it is not advisable to start a business until you have received a decision from the TE Office.