UKKO Entrepreneur – The easiest tool for managing day-to-day operations

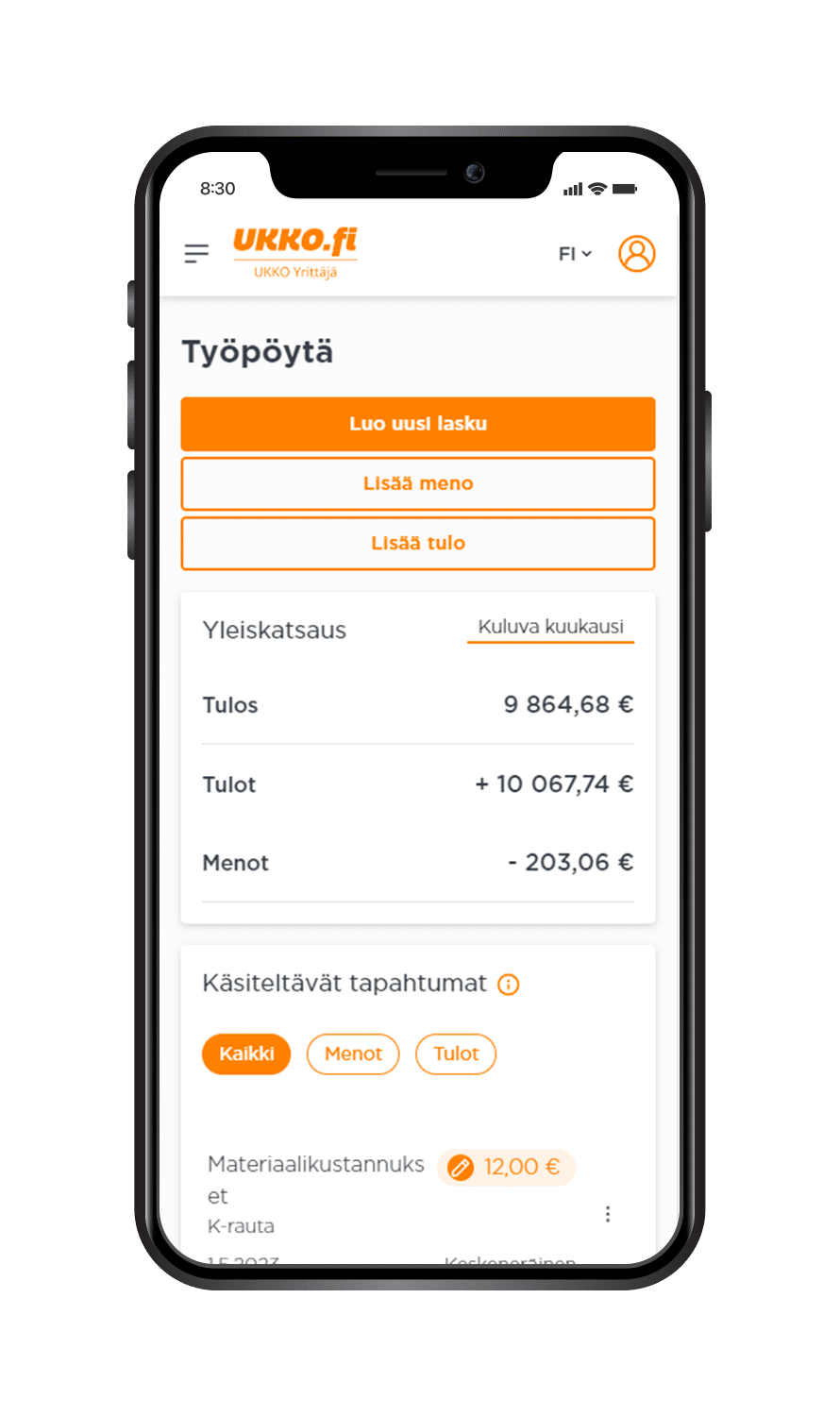

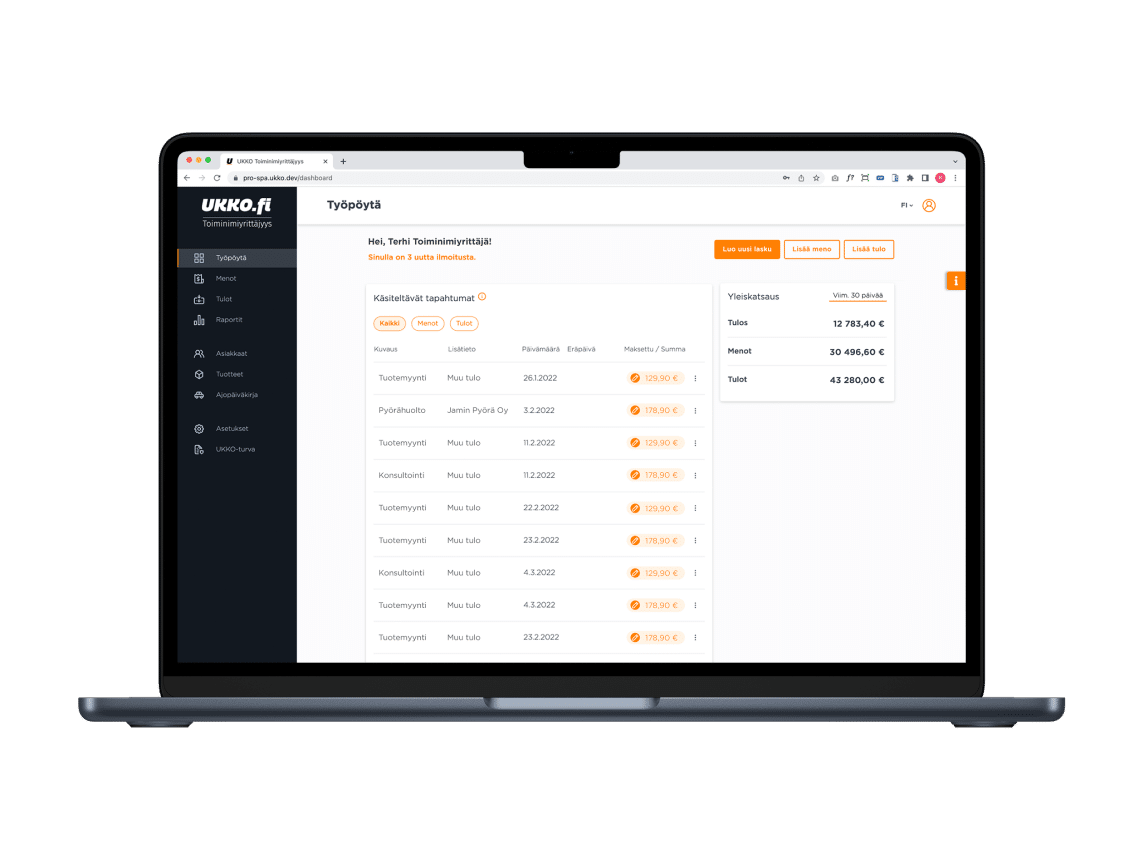

UKKO Entrepreneur will make your entrepreneurial path easier. It’s a reliable tool that carries with you as a private trader or limited company entrepreneur, where you can find everything you need regarding to your bookkeeping or invoicing.

Why UKKO Entrepreneur is better than a bookkeeper?

A fixed cost, you know what you pay for

UKKO Entrepreneur’s monthly fee includes everything you need to manage your company’s finances. No surprising extra costs!

Tax returns are included in the service

Regardless of the service fee, the service includes all features, from unlimited invoicing to VAT and tax returns.

A service designed for the needs of an entrepreneur

In the UKKO Entrepreneur service, you don’t pay for nothing. The service is designed perfectly for the needs of an entrepreneur – as a simple and easy tool for you.

Invoice easily, keep your accounting and receipts safe – UKKO Entrepreneur is suitable for a private trader and a limited company

UKKO Entrepreneur for a private trader

You get to use the private trader’s digital financial management, you save time, and you always see the real-time financial situation of your company. As a new entrepreneur, we will set up a business ID for you free of charge, or you can register with your existing business ID.

In the service, you create and send unlimited number of invoices easily and quickly. You also receive all invoices in the same place, so all you have to do is add the receipts to the service as photos. In addition to bookkeeping, we prepare VAT and tax returns as well as the private trader’s income statements for you!

UKKO Entrepreneur for a limited company

You can now get the entire limited company’s financial management, from invoicing to accounting, through one service. We can help you change bookkeeping firms, or you can easily establish a limited company during registration. You just fill in the necessary information, and the foundation papers go to the Finnish Patent and Registration Office for approval.

The service includes the accounting of the limited company, unlimited invoicing, official notifications, financial statements, payment of the entrepreneur’s payroll and other features that make everyday life easier. It is best suited for an entrepreneur who invoices for their own work.

Fixed price, no surprise costs

UKKO Entrepreneur for private trader

MONTHLY FEE AFTER THE TRIAL PERIOD STARTING FROM 22 € / MONTH + VAT

With the UKKO Entrepreneur service, you get all the tools of an entrepreneur at an affordable price! No per-piece fees or other surprises.

The affordable monthly price includes accounting for a private trader, invoicing, official notifications and other smart features that make invoicing, adding vouchers and monitoring your finances easier.

+ vat Monthly fee after the trial period

UKKO Entrepreneur for a limited company

MONTHLY FEE AFTER THE TRIAL PERIOD 120 €/MONTH + VAT

We want our pricing to support small entrepreneurs starting out. As a new entrepreneur, you can use our service for free for up to six months. You don’t have to pay anything unless you invoice your customers or generate revenue during that period.

Our affordable monthly price includes the limited company’s accounting, invoicing, authority notifications, financial statements, payroll of the entrepreneur’s salary and other handy features that facilitate invoicing, adding receipts and monitoring your finances.

+ vat Monthly fee after the trial period

UKKO Assurance – so that no entrepreneur is left relying on their own luck

UKKO Assurance is a comprehensive insurance for entrepreneurs. It helps in many situations, such as agreeing on valid assignments or accidents or damages that occur at work.

As a responsible operator, we want to ensure that we provide our users with the best conditions to operate as an entrepreneur within the framework of laws and regulations, safely and of course reliably.

Everything you need in one place

UKKO add-on services are designed to meet the most common needs of entrepreneurs.

UKKO Business Account

Business account quickly and affordably

We now offer UKKO Entrepreneurs an even more comprehensive service. You can easily get everything you need for financial management – from the UKKO Business Account and payment card to accounting and, of course, invoicing.

UKKO Assurance

UKKO Asurance – so you are not left on your own

UKKO Assurance’s liability and accident insurance make entrepreneurship safe and reliable. In addition to insurance, it provides helpful documents and numerous valuable benefits to support your business.

The UKKO Assurance service for UKKO Entrepreneurs now also features legal expenses insurance and legal assistance!

UKKO Checkout

A card reader for businesses and small entrepreneurs: an easy and affordable way to accept card and contactless payments.

Charge your customers easily on-site using a modern card reader or directly from your phone. Low transaction fee – only 0.99% per payment!

Foreign trade

Invoice foreign business and private customers

With the foreign trade service, you can invoice your foreign customers in euros, in Finnish or English.

We make the necessary corrections to your accounts.

We help you in everything related to your entrepreneurship.

You get all the features you need

93%* of our customers have been satisfied with our customer service

Our competent customer service and financial administration are always at your side, both online, on the phone, and via e-mail. We make sure that your entrepreneurship doesn’t stop at the wheel of bureaucracy.

Do the same as thousands of other entrepreneurs: Transfer your bookkeeping to us and enjoy the true freedom of an entrepreneur. Focus on your own work and grow your business. That is our common goal.

* UKKO.fi’s user satisfaction measurement, where all customer service contacts were measured

Private Trader or Limited Company?

As a user of the UKKO Entrepreneur service, you can choose between registering as a private trader or a limited company. A private trader is typically suitable for small-scale business activities. It’s easy to establish and, if necessary, to discontinue. However, if your operations are more extensive, full-time, and your business revenue is significant from the start, a limited company might be a better choice. Additionally, as your business grows from small to larger, it’s often wise to update your business structure to a limited company at some point. A limited company is better suited to larger-scale operations, particularly due to tax benefits and risk management.

Setting up as a private trader is the fastest and simplest way to begin your entrepreneurial journey. A limited company becomes a worthwhile option once your business is expanding.

Both private trader and limited company registrations have been made easy through the UKKO Entrepreneur service. During registration, you simply fill in the necessary details on the online form. Your private trader registration is processed automatically and instantly through our interface. If you decide to establish a limited company, we automatically generate the required documents, submit your application to the Trade Register, and provide full support from start to finish. Once your business is set up, accounting and invoicing are just as simple for both private traders and limited companies through the UKKO Entrepreneur service.

How to Choose the Right Business Form for You

Starting out as a private trader is an excellent way to begin your entrepreneurial journey. If you’re uncertain about how much revenue your business will generate or whether it will be viable in the long run, starting as a private trader is a good option. A private trader is also easy to terminate if the business doesn’t gain traction. Additionally, bookkeeping for a private trader can be done on a single-entry basis — just upload your income and expense receipts to the UKKO Entrepreneur service, and your accounting is taken care of almost automatically.

As a private trader, all the business’s income is considered your personal taxable income, which means you’ll pay progressively higher taxes as your income increases. You are also personally liable for any debts taken out for your business. For these reasons, it’s advisable to transition to a limited company as your business grows.

Many entrepreneurs decide to switch their business form from a private trader to a limited company when their income tax rate becomes too high. While every euro earned by a private trader is considered taxable income, a limited company entrepreneur can decide how much salary to pay themselves and leave the remaining funds in the company account. This helps keep the income tax rate reasonable. Additionally, as operations expand, a limited company makes it easier to manage increasing risks. Unlike a private trader, who is personally responsible for everything, a limited company assumes some of the operational risks.

If your business is still small-scale, it’s advisable to start as a private trader. Later, you can switch to a limited company if your income grows or if you need external funding, for example.

Thinking About Becoming an Entrepreneur?

Entrepreneurship with a business ID suits a variety of situations. Occasional gigs can be managed without your own business ID, either using a tax card or invoicing as a light entrepreneur. However, if your side job becomes regular, it might be a good idea to establish a private trader business or a limited company for that purpose.

Entrepreneurship is ideal for someone with the drive and passion to work on something meaningful and enjoyable. Are you passionate about crafting but your family and friends already have their closets full of the wool socks you’ve knitted? Start a private trader business and an online store, and put your crafts up for sale!

On the other hand, entrepreneurship can also be a way to employ yourself in a field where finding traditional employment is challenging. If gig work is available but long-term employment isn’t feasible — perhaps due to the project-based nature of the work or seasonal fluctuations — you might find it easier to get gigs if you can invoice through your own business. As an entrepreneur, you can also work for several clients simultaneously and on overlapping projects.

Entrepreneurship is often driven by passion as well: you have a brilliant idea and want to offer your product or service to those who need it. In this case, entrepreneurship becomes an obvious choice, even though getting started might require extensive planning and courage. In such situations, it’s usually best to start as a private trader, keeping in mind that it’s wise to transition to a limited company once your idea takes off and your income grows significantly.

Before choosing a business form and registering your business, you need to have a business idea — a clear understanding of what your business will actually do. A business idea takes shape when you answer the following questions:

- What is the purpose of your business?

- What product or service are you selling?

- Who are your customers?

- How will sales take place in practice?

- What makes your business stand out?

- Why will customers choose you over your competitors?

Reflecting on your business idea can take time. It might relate to your profession, hobby, or other interests. Entrepreneurship is versatile and suits a wide range of needs, with virtually no limits to what you can do or the ideas you can bring to life. Only the sky’s the limit!

As a Private Trader or Limited Company Entrepreneur, you could:

- Leverage your expertise to organize training sessions or sell online coaching programs.

- Create and sell jewelry, accessories, or home decor items.

- Perform construction and renovation work for private customers or businesses.

- Design and develop websites or applications.

- Offer marketing services, such as social media management, search engine optimization, or ad campaign planning.

- Write articles and other content as a freelance writer for various media outlets or companies.

- Organize events like conferences, weddings, or other celebrations.

- Open your own art gallery to showcase and resell the works of local artists.

What Are an Entrepreneur’s Responsibilities – and How Does UKKO Help with Them?

One of the entrepreneur’s primary responsibilities is reporting and paying taxes. UKKO assists with this by preparing your tax and VAT declarations and guiding you through the tax payment process. However, entrepreneurs must apply for tax prepayments (advance income tax) themselves via the vero.fi website. We’ll remind you when it’s time to apply for or update your prepayment declaration.

Additionally, entrepreneurs must manage some responsibilities that employers typically handle for employees, such as insurance and social security arrangements.

With the UKKO Entrepreneur service, regardless of your business form, you get access to UKKO Assurance, which includes the most common insurance types entrepreneurs need, along with other valuable benefits and services. UKKO Assurance also provides templates for creating contracts, such as agreements for client projects. It’s important for entrepreneurs to protect their interests by formalizing project and task agreements in writing.

How the UKKO Entrepreneur Service Works

Using the UKKO Entrepreneur service is straightforward. To get started, you need to register — you can either use an existing business ID or we can establish a new business for you during registration.

If you want to obtain a business ID while registering, the online form will collect all the information needed to set up your business. Setting up a private trader business requires only a small amount of information, whereas creating a limited company involves slightly more details.

Once your business is registered and the service is activated, you can start invoicing and uploading receipts for bookkeeping. Through the UKKO Entrepreneur service, you can create and send invoices to your clients via post, email, or e-invoice. Additionally, you can save client and product details in the customer and product registry, making it even faster to generate invoices.

The service features intelligent automation to simplify bookkeeping. When you upload a photo of an expense receipt to the UKKO service, our system reads the receipt data and automatically fills in the bookkeeping entry. All you need to do is verify that the system has correctly interpreted the information and provide a description of how the expense relates to your business. Monthly, our bookkeeping and financial experts review your bookkeeping materials and will contact you for clarification if any income or expense needs further explanation.

We also prepare your annual tax declaration for your business. Additionally, we handle your VAT declarations monthly, quarterly, or annually, depending on your VAT cycle. If we need additional details before completing and submitting your VAT declarations to the tax authority, we’ll provide you with clear instructions.

Here’s How It Works:

- Register for the service (either with an existing business ID or let us set up your business).

- Start invoicing.

- Save your products, services, and client details in the system.

- Upload receipts as images for bookkeeping.

- Reach out to our top-notch customer support anytime you have questions!

We are happy to help you with choosing your business form and service!

Couldn’t find information about the issue you’re concerned about, or are you wondering what business form would be most suitable for you, or how our services differ from each other?

Entrepreneurship and Taxation

Taxation for private traders consists of two parts: the entrepreneur’s income tax (prepayment tax) and value-added tax (VAT). For limited company entrepreneurs, there are four types of taxes to consider: corporate tax (paid on the company’s profits), VAT, the owner’s personal income tax, and tax on dividends.

Entrepreneurs can also take advantage of various tax deductions. For instance, VAT deductions on purchases mean that if you buy a new computer or drill for business use, you can deduct the VAT on the purchase from the VAT you pay to the tax authority.

Taxation might initially feel confusing and complicated, but the UKKO Entrepreneur School offers a comprehensive library of articles that clarify the principles of taxation. Nevertheless, you might still encounter questions or uncertainties about specific details. That’s why our customer support team is always happy to assist and provide guidance on tax matters.

The UKKO Entrepreneur service aims to simplify taxes as much as possible. We prepare your tax and VAT declarations for you, and our customer service is always available to help when needed!

Entrepreneurship and Social Security

Entrepreneurs are more responsible for their own social security compared to employees. An entrepreneur’s social security is primarily based on the YEL insurance (self-employed persons’ pension insurance). YEL insurance is taken out through a pension insurance company, and the premium is based on an income estimate agreed upon by the entrepreneur and the pension company. This estimated income reflects the monetary value of the entrepreneur’s work contribution.

If an entrepreneur becomes ill, has an accident, becomes unemployed, or takes parental leave, the level of social security is determined by the amount of the YEL premium paid. Therefore, it’s wise to set your YEL insurance at a level that accurately reflects your true work contribution.

To protect against unemployment, it’s recommended that entrepreneurs join an unemployment fund for entrepreneurs. This works similarly to employee unemployment funds: if your work ends, the fund provides benefits equivalent to earnings-based unemployment security. However, note that contributions to the unemployment fund are not deductible for the business, but they can be claimed as deductions in your personal tax return.

Through the UKKO Entrepreneur service, you can easily take out a YEL insurance policy. At the very start of your business or when your operations are very small-scale, YEL insurance is not mandatory. During this phase, entrepreneurship is usually secondary, and social security is covered through full-time employment. YEL insurance becomes relevant after your business has been running for over four months and certain other conditions are met.

As your operations expand, we’ll notify you via email when your growing income makes YEL insurance necessary, and you can apply for pension insurance directly through the UKKO Entrepreneur service.