Affordable accounting for a private trader

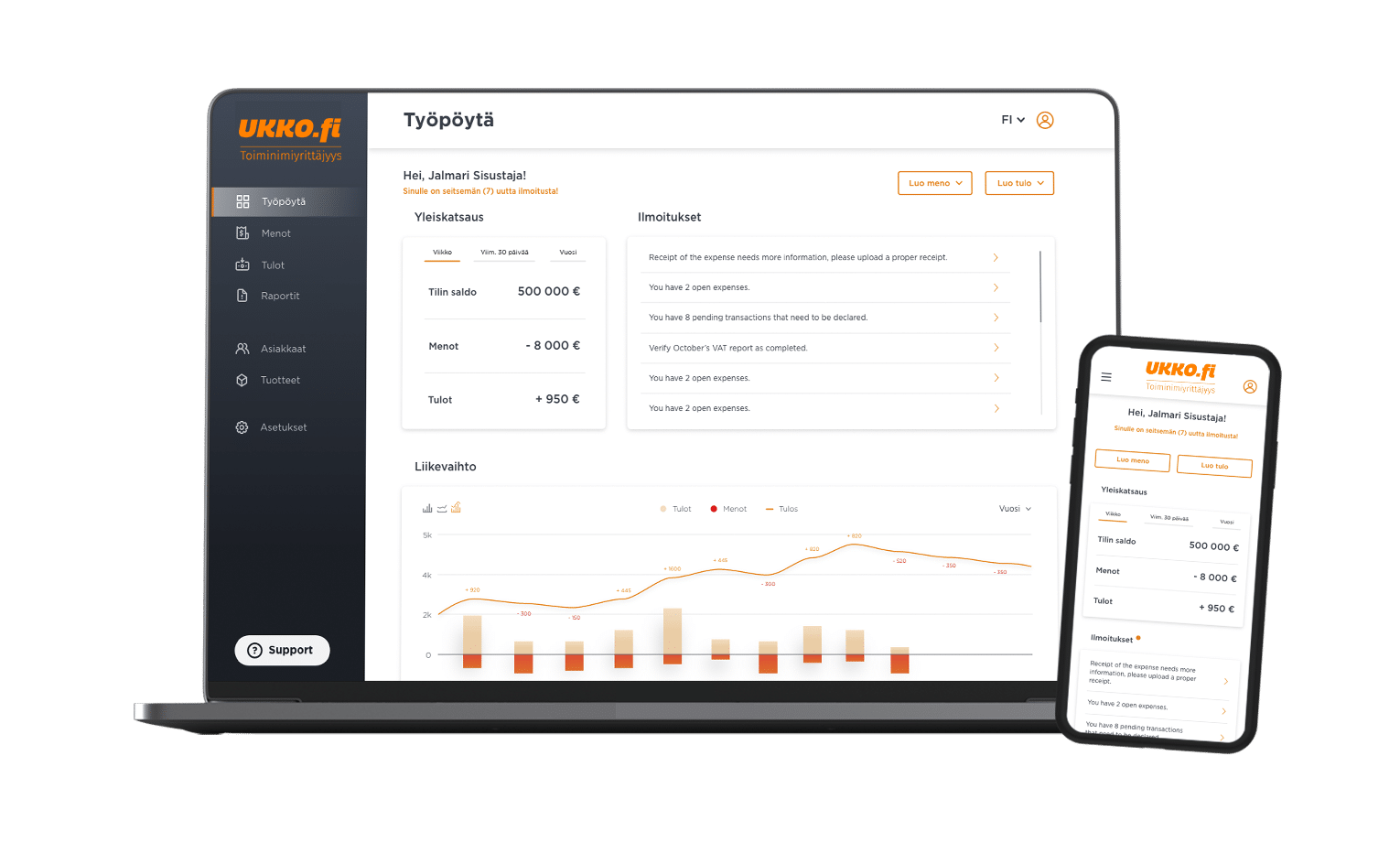

UKKO Entrepreneur has everything you need for financial management. Versatile and flexible accounting for a private trader always available.

From invoicing to tax returns – all at an affordable monthly price

Easy financial management

All the necessary tools in one place, from invoicing to accounting.

You know what you’re paying for

With a fixed monthly price, you get everything you need. No additional fees or hidden costs!

Customer service is there for you

Our customer service will help you in all matters, both by phone and e-mail.

Private trader accounting made easy – focus on what you do best

Let us make your business easier. With the UKKO Yrittäjä service, your financial management is digital, you save time, and you can always see the real-time financial situation of your company. Join thousands of small business owners now!

Everything you need for a fixed monthly price

- Leave the bookkeeping to us

- Send and receive invoices easily

- Save your receipts effortlessly

Unlimited everything – no surprise costs from receipts or button presses

Send and receive invoices as an online invoice, by e-mail or by mail – the monthly price includes an unlimited number of invoices. You also stay well informed about your company’s finances with the help of real-time financial monitoring.

Take advantage of additional services as well! Create customer and product registers, use the driving diary in your work and order a Zettle payment terminal through us. Zettle sales reports directly to the service.

Tax returns and VAT relief without worries – we take care of them for you

You don’t have to worry about VAT and tax returns, because we handle them for you for the tax authorities. We will also apply for a VAT relief for you if your turnover falls below 30 000 euros – as an independent entrepreneur, you will get money back from the tax authorities when your operation is small-scale!

We help with the change of bookkeeping firm

The UKKO Entrepreneur service makes it easier to run your private trader. Register directly with your current business ID and get all the features to use quickly! We help you change the bookkeeping firm for free, and for an additional fee we also take care of undone bookkeeping.

Note! If you don’t have a business ID yet, you can easily get one through us when you register.

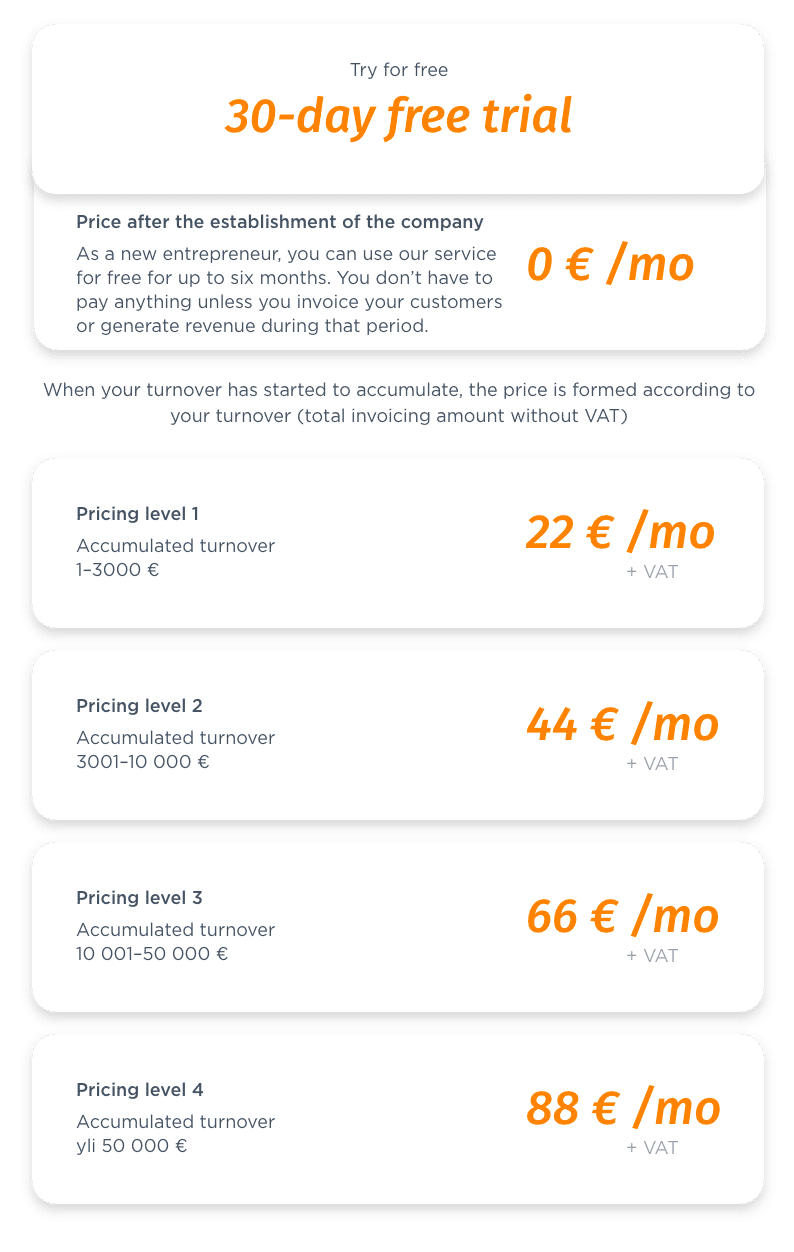

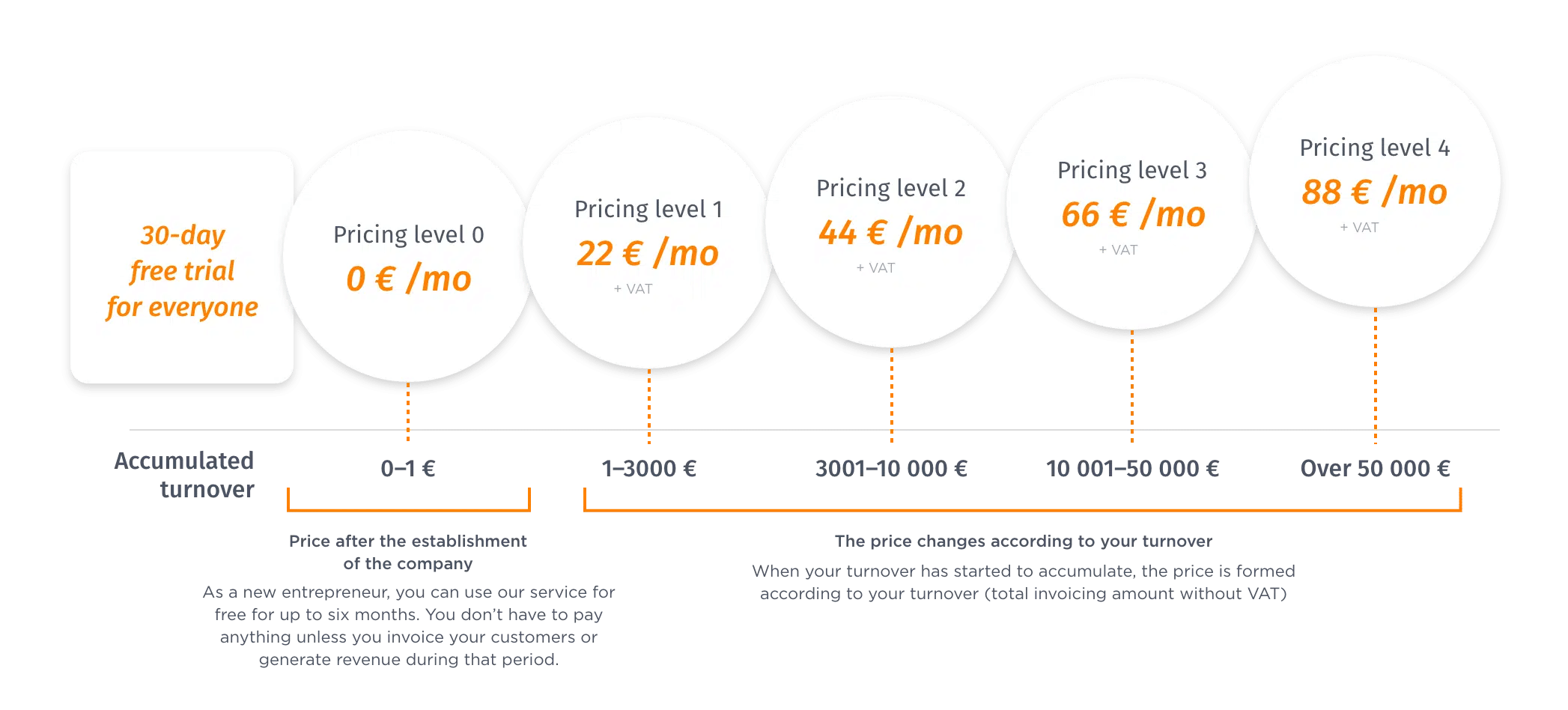

Know what you’re paying for – clear monthly pricing

The affordable monthly price includes accounting, invoicing, official notifications, and other handy features that facilitate invoicing, adding receipts and monitoring your finances for a private trader.

Starting entrepreneur: you only pay for the service when you receive the first payment from your clientWe want our pricing to support small entrepreneurs starting out. As a new entrepreneur, you can use our service for free for up to six months. You don’t have to pay anything unless you invoice your customers or generate revenue during that period. We want to encourage entrepreneurs and have therefore made the initial steps as easy as possible for entrepreneurs. |

An affordable fixed-term contract for those who invoice a lot – save 132 eurosOur pricing is based on accumulated turnover. When the company’s lifetime turnover reaches the 50 000 euro limit, you save 132 euros by using a 12-month fixed-term contract, in which case you pay only 77 euros + VAT/month for using the service. You can use the fixed-term contract easily from the service settings section. |

UKKO Assurance – so that no entrepreneur is left relying on their own luck

UKKO Assurance is a comprehensive insurance for entrepreneurs. It helps in many situations, such as agreeing on valid assignments or accidents or damages that occur at work.

- Insurances: accident and liability insurance

- Agreement template library

- Power of attorney’s and documents

- Sales school and marketing school

- Other benefits, e.g., car rental companies and offices

UKKO Assurance is available to all registered users. Assurance is activated from the UKKO Assurance tab within the service.

Everything you need in one place

UKKO add-on services are designed to meet the most common needs of entrepreneurs.

UKKO Business Account

Business account quickly and affordably

We now offer UKKO Entrepreneurs an even more comprehensive service. You can easily get everything you need for financial management – from the UKKO Business Account and payment card to accounting and, of course, invoicing.

UKKO Assurance

UKKO Asurance – so you are not left on your own

UKKO Assurance’s liability and accident insurance make entrepreneurship safe and reliable. In addition to insurance, it provides helpful documents and numerous valuable benefits to support your business.

The UKKO Assurance service for UKKO Entrepreneurs now also features legal expenses insurance and legal assistance!

UKKO Checkout

A card reader for businesses and small entrepreneurs: an easy and affordable way to accept card and contactless payments.

Charge your customers easily on-site using a modern card reader or directly from your phone. Low transaction fee – only 0.99% per payment!

Foreign trade

Invoice foreign business and private customers

With the foreign trade service, you can invoice your foreign customers in euros, in Finnish or English.

We make the necessary corrections to your accounts.

We help you in everything related to your entrepreneurship.

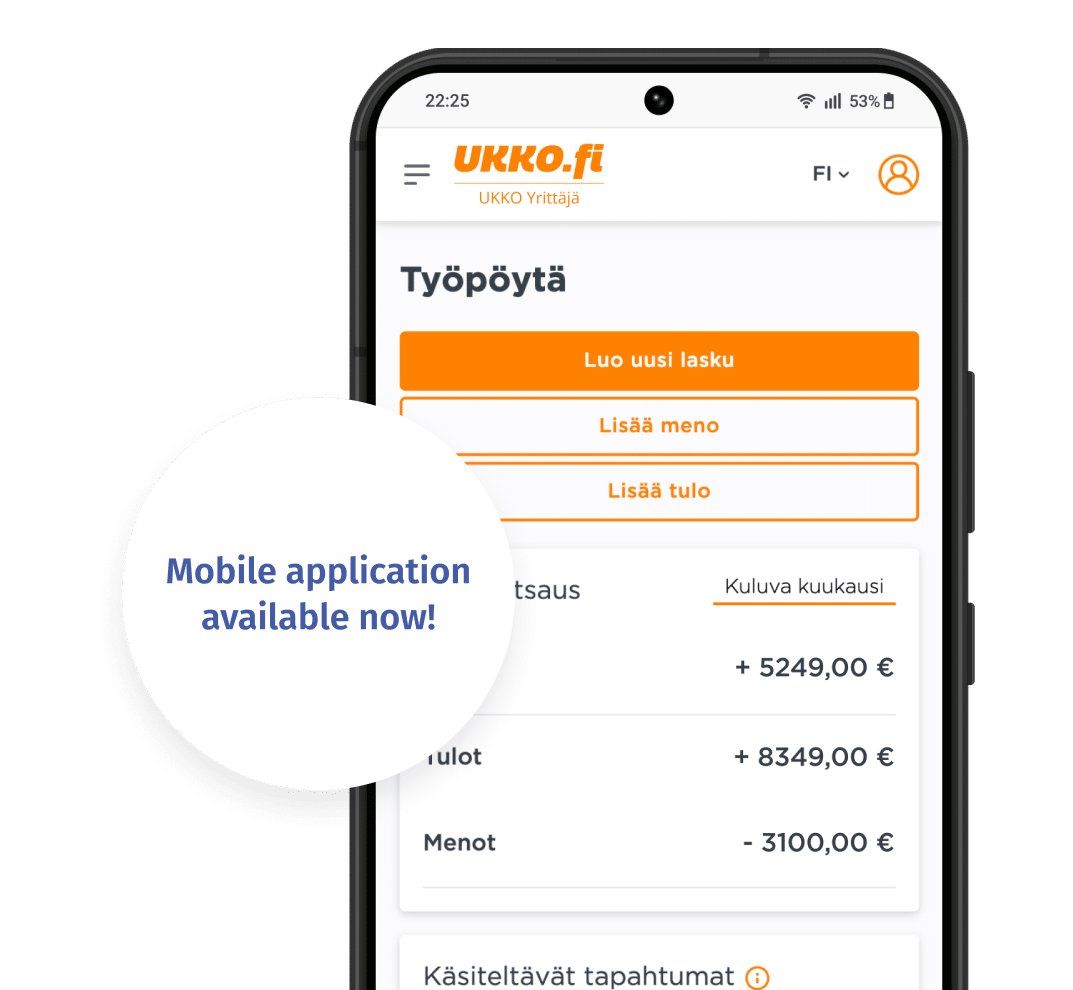

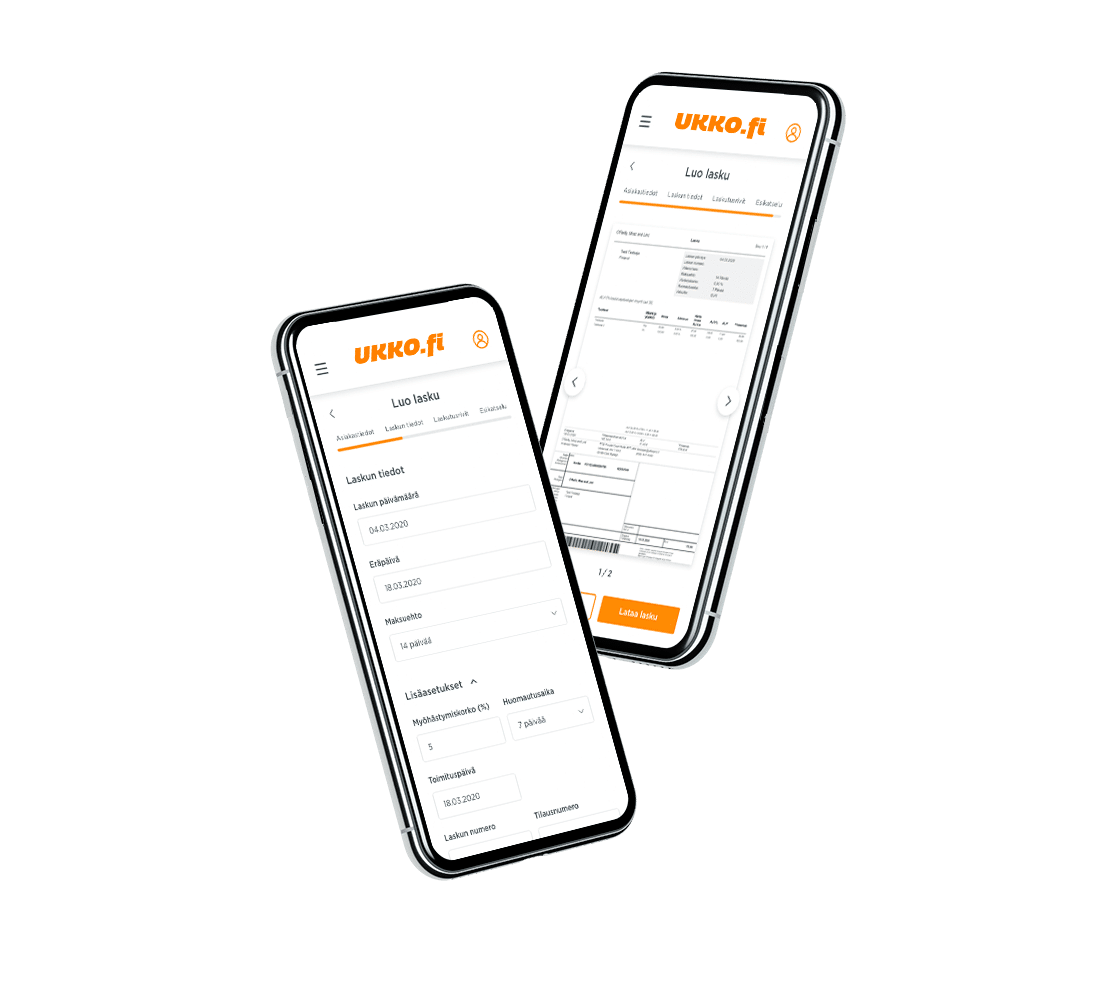

UKKO Entrepreneur service app for private traders

The application enables even easier and faster accounting for small entrepreneurs. You will find in the application all the same features as on the website, so you can streamline your everyday life by using the mobile application wherever and whenever it suits you!

Download the accounting and financial management tool in your pocket from the app store!

If you are a new private trader:

Examples of pricing:

If you already have a business ID:

Examples of pricing:

No matter what you need, we will help with that.

We are happy to serve our customers’ other needs flexibly. That’s why we have priced any additional services you may need in advance.

You get all the features you need

We will assist you in all aspects of private trader entrepreneurship

Help is always close

Our customer service will assist you with all matters related to private trader entrepreneurship, both over the phone and via email. You can also find a wealth of articles, advice, instructions, and tips on entrepreneurship at UKKO.fi.

Do you have any questions?

Could I be a private trader? How do I start? See answers to frequently asked questions. If for some reason your question cannot be answered. Please contact our customer service!

Contact us

Jimi Forsman

Sales Representative

+358 50 434 7273

jimi.forsman@ukko.fi

Miro Tiala

Sales Representative

+358 50 460 2442

miro.tiala@ukko.fi

Focus on your business. We take care of paperwork and accounting.

You can easily and quickly create and send invoices with the same service. You’ll also receive all your invoices in one place, so all you need to do is add receipts conveniently as images. Our experts and accounting professionals ensure that everything is done correctly. Private trader accounting has never been this easy.

We use modern techniques such as machine learning and automation, but ultimately, an expert checks that your accounting is done correctly. You can always get assistance from our skilled experts for accounting and financial management, and the advice is always completely free.

Income tax return and VAT threshold relief application taken care of on your behalf.

You don’t have to worry about VAT and tax returns because we handle them on your behalf with the tax authorities. We also apply for the VAT threshold relief for you when your turnover is below 30,000 euros – as an independent entrepreneur, you’ll get a clear refund from the tax authorities when your operations are small-scale!

We want to make entrepreneurship as easy as possible for our customers. You don’t need to be an expert in financial management or tax matters because we are. You can confidently leave the accounting and government reporting to us and focus on what you’re good at and enjoy doing.

The less time you spend on bookkeeping and paperwork, the more you can concentrate on growing your business!

1. Send an invoice2. Save your receipts3. We take care of accounting and paperwork

This is how easy private trader accounting is with UKKO Entrepreneur service!

Private trader with UKKO Entrepreneur – an easy and hassle-free way to start your business using your expertise!

UKKO Entrepreneur is UKKO Group’s financial service designed for private traders, offering bookkeeping and invoicing solutions. Through this service, you can become a private trader and outsource time-consuming financial tasks, such as bookkeeping and tax matters, to us. Every private trader using our service receives guidance and support for managing financial responsibilities.

- If you invoice regularly, operating as a private trader can leave you with a larger share of your income compared to being a light entrepreneur. This is because you can benefit from tax deductions and the VAT relief threshold. Additionally, UKKO Entrepreneur doesn’t charge fees per invoice—our monthly fee includes unlimited invoicing, both sent and received.

- Simplify bookkeeping and invoicing for your private trader business. You can start invoicing as soon as your business ID is issued and your registrations for prepayment and VAT are processed. If you already have a business ID, you can begin using the service immediately.

- Say goodbye to the hassle of VAT and tax filings — we handle these for you. You can also obtain YEL insurance easily through our service.

- You’re not Alone in your entrepreneurship. We are here to support you as you grow your business. Gain access to the resources in our Entrepreneurship School for helpful advice, and feel free to contact our experts for assistance with any questions about entrepreneurship.

Who is the UKKO Entrepreneur service for?

If you’re looking to earn more as an entrepreneur and grow your business, starting a business as a private trader is a smart choice. Currently, over 100,000 Finnish entrepreneurs operate as private traders. Typical private traders include hairdressers, graphic designers, consultants, construction professionals, massage therapists, and taxi drivers. You can pursue private trader entrepreneurship either full-time or part-time.

UKKO Entrepreneur is perfect for you if:

- You’re frustrated by dealing with endless receipts and documents and want a modern way to manage bookkeeping and invoicing for your private trader business.

- You want to focus on doing the work you love.

- You’re considering entrepreneurship or want to test a business idea.

- You want to become an entrepreneur, but handling financial matters feels daunting.

- You’re unemployed and looking to employ yourself as an entrepreneur.

- You dream of entrepreneurship but are intimidated by Y3 forms and other paperwork.

Earn more as a private trader – start your entrepreneurship journey easily!

With the UKKO Entrepreneur service, you’ll receive a business ID and can begin invoicing your clients immediately after registering.

As a private trader, you don’t need to worry about bookkeeping or other paperwork, as we handle these tasks for you at UKKO Entrepreneur. This allows you to focus your time on more productive activities, like acquiring clients and growing your business. Through our service, you can easily send invoices to your clients and save their details, along with product information, in an intuitive registry to speed up future invoicing.

How do private traders earn more?

- You can deduct all business-related expenses, such as a work laptop or your phone, in your taxes.

- You benefit from VAT relief.

- You are entitled to a 5% entrepreneur deduction from your taxable income.

- You don’t pay employer contributions on your invoiced income and can send an unlimited number of invoices for a fixed monthly fee.

Join the UKKO Entrepreneur service for free!

Registration is free and comes with no obligations.

Visit our Pricing section to explore our fees in detail.

If you still have questions, don’t hesitate to reach out to our customer support team:

Our customer service is available Monday to Friday, 9 AM–4 PM, at 09 427 208 61 or via email at asiakaspalvelu@ukkopro.fi.