Private trader bookkeeping at a low cost!

Forget paperwork and focus on your own skills. UKKO Private Trader takes care of bookkeeping, VAT returns and tax returns on your behalf.

Get started with private trader bookkeeping today!

We take care of paperwork and bookkeeping for you – Personal customer service available for your securityEverything you need for sole trader bookkeeping

In addition to our easy-to-use program, you don’t need any other tools for accounting

-

Private trader bookkeeping

UKKO Private Trader handles private trader bookkeeping quickly and securely. You can focus on your own skills.

-

Send invoices

Easy to use invoicing tool for the same price. You can send and receive invoices from the service directly as e-invoices, by mail, or by email.

-

Take a picture of the receipts

No more missing receipts. Take a photo of the receipts on your mobile phone and add them to the service. Fast and easy!

-

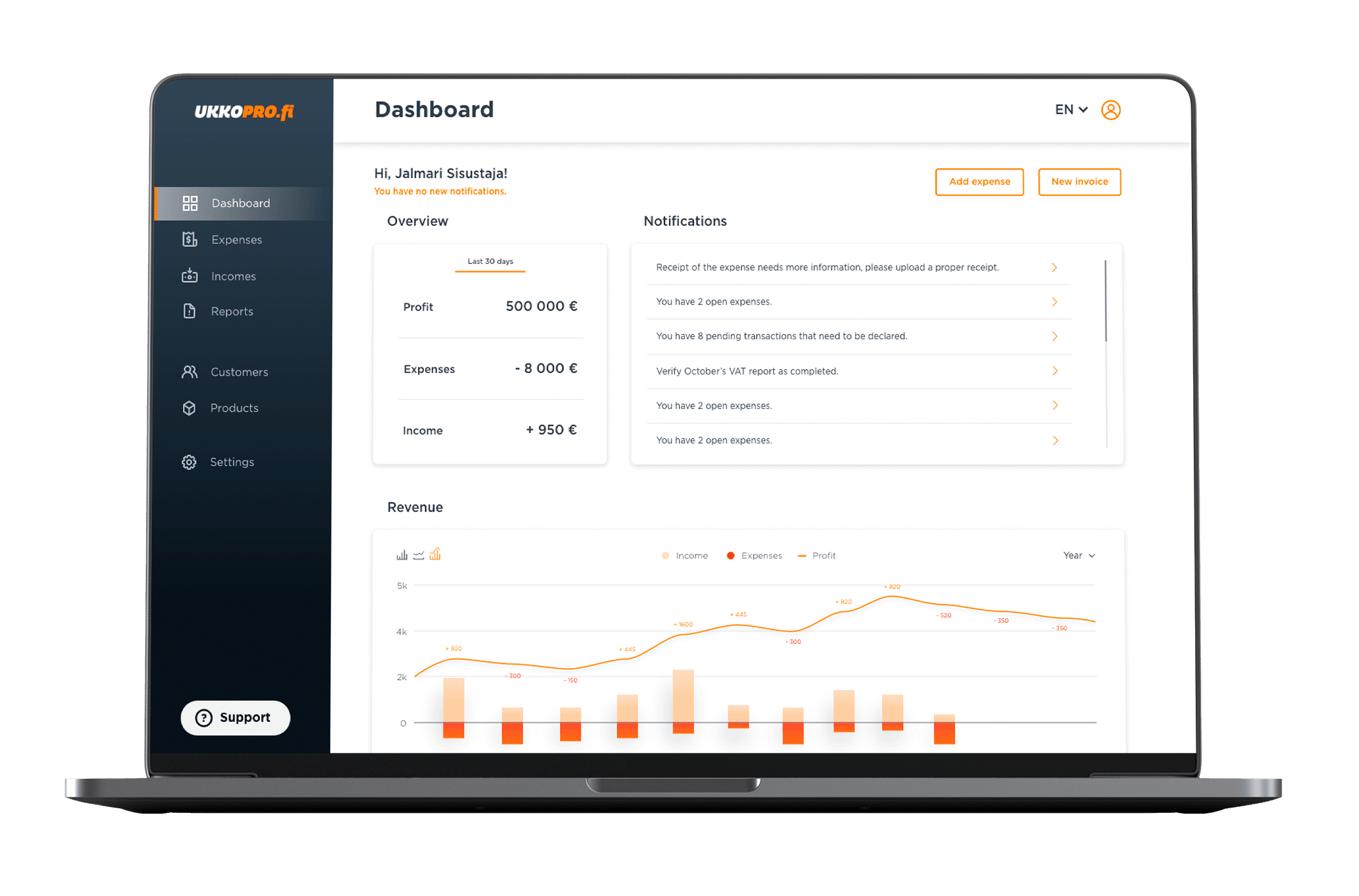

Simple to use system

Our modern system makes your life easier. The service is easy and effortless to use.

-

VAT returns

We prepare VAT returns for you and also send them to the tax authorities.

-

Customer and product register

To make invoicing easier and faster in the future, save your customers and products in an easy-to-use product and customer register.

Private trader financial administration in one package

Private trader bookkeeping does not have to be complicated and cumbersome. And it is not when you use the right tools. UKKO Private Trader is such a tool. We want to help Finnish companies grow, and paperwork must not be an obstacle here. We have also priced our service to be encouraging. In the beginning, business is small-scale and there is no reason to pay too much.

We want to make private trader financial administration easy, effortless and reasonably priced. With UKKO Private Trader, you can easily modernize your private trader bookkeeping.

The UKKO Private trader bookkeeping service simplifies financial management

- Make invoices via UKKO Private Trader

- Take a picture of the receipts and add them to the system

- UKKO Private Trader compiles bookkeeping and makes VAT and tax returns on your behalf

Of course, our service has a number of handy features that will speed up your work. You have access to customer registers, product registers and you can send e-invoices directly from our system. All for the same price.

Changing an accounting firm is easy

If your business is already up and running and you have an accounting service, accounting program, or hired accountant, you can easily transfer your accounting to us. When registering, you simply select the option “change accounting firm” and follow the instructions.

You can easily change your accounting firm through us, we will contact your accounting firm and take care of the transfer for you! If you have made the accounting for the current year yourself, we can do the accounting for the beginning of the year as arrears accounting at a price of 50 € / month + VAT 24%.

You will never be left alone.

Our knowledgeable customer service and financial department are always there to support you, online, by phone and via email. We make sure that your business won’t stop because of bureaucracy.

Follow thousands of other Finnish entrepreneurs: Transfer your bookkeeping to us and enjoy true entrepreneurial freedom. Focus on your own work and grow your business. That is our common goal.

- All financial services from one place

- Works on all devices

- Our team to support you

- Already over 4,000 users!

- Reliable domestic bookkeeping service

- You can also order a Zettle payment terminal through us: link the device to our service and the sales reports will be transferred directly to your accounting

We are also constantly developing our service and we have a long list of new features coming. The purpose of all these reforms is to make the life of a private trader easier.

Leave the paperwork to us

Unlimited invoicing and proofing, as well as VAT and tax returns are included in the monthly price

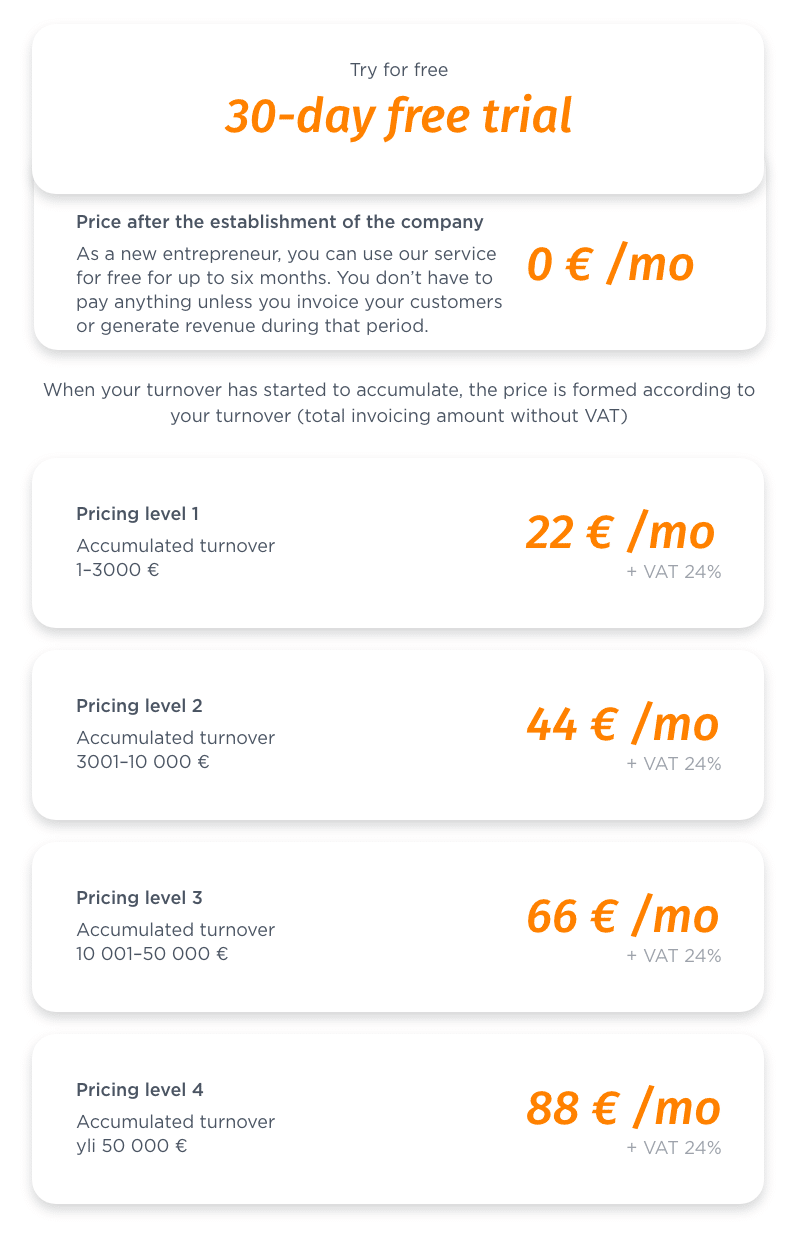

Fair monthly price without surprises

The fixed monthly price includes private trader’s accounting, billing, VAT and tax returns, and other handy features that make it easy to bill, add vouchers, and track your finances.

30 day free trial for everyone

Try our service for 30 days free of charge. Find out how easily things can be done when a small business owner has been at the center of the service design.

Affordable fixed-term contract when billing a lot

Has your turnover already reached 50 000 €? Save 228 euros and use a 12-month fixed-term contract, in which case you only pay 69 € + VAT / month for using the service. You can easily choose this option after registration from the settings section.

The easiest way to do private trader bookkeeping

With the help of UKKO Private Trader, you take care of your company’s invoicing and bookkeeping. Automated features save a lot of time so you can focus on your core business.

You can send invoices, add receipts, and manage your sole trader bookkeeping worry-free, regardless of device. Receipts will no longer be lost when you take a picture of them immediately after purchase. You can also view, for example, whether your customer has paid the invoice, conveniently by phone.

Sole trader invoicing, receipts, bookkeeping and VAT returns

Keep invoices, receipts and other documents related to your company’s finances in UKKO Private Trader. When you receive or send invoices in our service, the information is automatically transferred to the books. We’ll take care of the documents.

Device independent

Do the bookkeeping when it suits you best. On the couch at home or on a trip, you decide where and how. UKKO Private Trader can be used with any device. Laptops, tablets and phones. No programs to install!

No opening fee!

You can use UKKO Private Trader bookkeeping without an expensive opening fee. You only pay for our service according to the accumulated turnover.

The use of the service also does not bind you to long contracts and notice periods. We trust that you will be satisfied with our service!

No programs to install

Our service works easily with any device and from anywhere. No compatibility issues. Easy and simple, right? All you need is an internet browser, which you are using to read this page right now.

Product register

Set up easy-to-sell products and speed up your invoicing. Make automatic invoices for products. No unit limits!

Customer register

Store unlimited customers in your own system easily and quickly. You can invoice existing customers in an instant.

By mail and e-invoice

Single-entry bookkeeping includes both sales invoicing and purchase invoicing. You can send invoices from the service directly as e-invoices, by mail or by email.

Purchase invoice service

- No limit on invoices, customers or products

- Customer register

- Product register and automatic exports to bookkeeping

- Receipt of paper invoices

- Receipt of e-invoices

- All receipts in the cloud

- Invoice according to standards

Income statement

The service includes a real-time income statement.

VAT returns automatically

UKKO Private Trader creates VAT calculations for you that you can easily report to the tax authorities.

Private trader taxes, VAT & tax prepayments …

Are business tax issues a headache? No worries, UKKO Private Trader also takes care of all the paperwork necessary for a private trader. You will receive clear reports on taxes payable and stay up to date on the financial situation of your company. We also offer comprehensive support services, by phone, email and through our website. For example, read about private trader’s taxes or view our other Frequently Asked Questions.

Leave private trader bookkeeping to us. We take care of the paperwork for you and you can focus on your own skills. If you’re not a private trader yet, we’ll help: Create a free business name as a private trader. As a starting entrepreneur, you also have the opportunity to apply for a startup grant from the state.

Sole trader bookkeeping – What does it contain?

According to the Accounting Act, every company is obliged to keep records of its business or professional activities. In principle, all accounting entities must do double-entry bookkeeping, but it is still possible for a private trader to do single-entry bookkeeping under certain conditions. Despite the legal obligation, bookkeeping is also useful, as it allows the entrepreneur to better stay on top of the profitability of his or her own business.

Sole trader bookkeeping: in-house or outsourced?

There are numerous ways to handle private trader bookkeeping. If the business is small-scale or part-time, the entrepreneur will be able to manage it personally, in which case it will not be necessary to acquire an accountant.

Alternatively, private trader bookkeeping could well be outsourced to professionals, so you don’t have to lose sleep due to bookkeeping troubles. You can focus on just your core competencies and what you really want to do.

Regardless of the accounting company, the entrepreneur is always personally responsible for the bookkeeping, even if it has been outsourced.

The easiest option for private trader bookkeeping?

As an UKKO Private Trader user, your bookkeeping is handled automatically and you only pay for the service based on your turnover. After registering for the service, you can immediately send the first invoices online.

The service is used by numerous photographers, consultants, builders, cleaners and beauticians who have wanted to reduce their workload by outsourcing financial administration to us.

Are you ready to outsource your accounting concerns?

Frequently asked questions

How do I start using UKKO Private Trader service?

You can become a user of the UKKO Private Trader service through our registration page, either with an existing business ID, or you can set up a business ID through us. For more information, see our Establishment of a Private Trader page.

Please note that one person can only have one personal Business ID. For example, if you already have a Business ID that was created several years ago and has since been discontinued, you will need to activate that business ID. You can do so with a change notice on the YTJ website.

Who can use UKKO Private Trader?

The service is designed for private traders (Tmi) who need to keep single-entry bookkeeping. You can be either a full-time or a part-time entrepreneur.

Our service, on the other hand, is not suitable for you if:

- Your business is agriculture and forestry or investment activities.

- Your business requires double-entry bookkeeping.

- You need regular payroll and you cannot use payroll services provided by a third party to calculate and pay your salaries.

- Your fiscal year is a non-calendar year.

- However, you can change your financial year to end on 31.12. before starting a customer relationship

- Products sold by your company are subject to marginal taxation. (e.g. used car dealerships or flea markets.)

- Inventory maintenance is an important part of your business, and you do not keep regular inventory.

- You should be able to provide an inventory list and value at the turn of the year and upon request.

- A significant inventory is often considered to be a stock intended for sale of approximately € 1,000.

- You have regular imports of goods from outside the EU (Please note that the UK is no longer part of the EU).

- Your business includes animals and related purchases (e.g. breeding), however training, grooming, walking dogs and other similar services are allowed

You can read more about this here.

How long does it take to get a business ID?

If you set up a business name through UKKO Private Trader, you get a Business ID after completing the registration.

What is included in the monthly price?

The monthly price of our service includes the following features:

- Automated accounting

- Unlimited invoicing: create and receive invoices in one place (incl. E-invoices and paper invoices)

- VAT and tax returns are made for you

- Applying for a VAT relief for you

- Customer and product register

- Real-time financial monitoring

- Free accountant support (chat, email and phone)

- Driving logbook

- Formation of the income statement

- Digital storage of receipts and vouchers

Is the service suitable for limited companies (OY)?

Currently, we only offer single-entry bookkeeping for private traders. Limited companies must do double-entry bookkeeping and therefore we cannot provide our accounting services to limited companies.

Does registration require a commitment to the service?

Registration for the UKKO Private Trader service is completely free. Registration also does not oblige you to use the service.